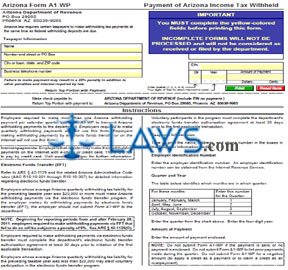

Form A1-WP Withholding Deposit Coupons

INSTRUCTIONS: PAYMENT OF ARIZONA INCOME TAX WITHHELD (Form A1-WP)

Arizona employers required to make more than one Arizona withholding payment to the state per quarter should file a form A1-WP to transmit these payments to the Department of Revenue. This document can be obtained from the website of the Arizona Department of Revenue. This form should only be filed with a payment. Do not submit a form A1-WP if no payment is being made or your liability is zero, or to claim a negative amount for a future credit.

Arizona Income Tax Withheld A1-WP Step 1: Detach the top portion of the page from the instruction portion on the bottom along the dotted line where indicated.

Arizona Income Tax Withheld A1-WP Step 2: Complete the form on your computer. All fields must be completed before printing the document.

Arizona Income Tax Withheld A1-WP Step 3: In the first blank line on the left, enter your name.

Arizona Income Tax Withheld A1-WP Step 4: In the second blank line, enter your street address.

Arizona Income Tax Withheld A1-WP Step 5: In the third blank line, enter your city or town, state and zip code.

Arizona Income Tax Withheld A1-WP Step 6: In the fourth blank line, enter your business telephone number.

Arizona Income Tax Withheld A1-WP Step 7: In the first blank line on the right, enter your employer identification number.

Arizona Income Tax Withheld A1-WP Step 8: In the first blank box below this, enter the quarter for which you are filing by entering "1" (ending in January, February and March), "2" (ending in April, May and June), "3" (ending in July, August and September) or "4" (ending in October, November and December) as appropriate. Enter "4" if submitting an extension or penalty payment.

Arizona Income Tax Withheld A1-WP Step 9: In the second blank box, enter all four digits of the year for which you are filing.

Arizona Income Tax Withheld A1-WP Step 10: In the third blank box, enter the size of the payment being made in dollars and cents.

Arizona Income Tax Withheld A1-WP Step 11: File the return by mailing it to the address given on the form along with a check. This check should be made payable to the "Arizona Department of Revenue." Include your employer identification number on the check.