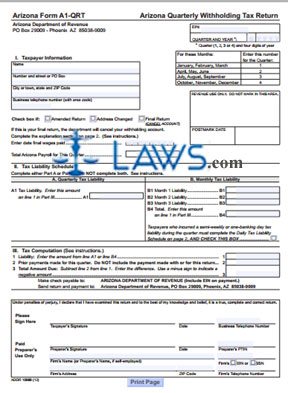

Form A1-QRT Arizona Quarterly Withholding Tax Return

INSTRUCTIONS: ARIZONA QUARTERLY WITHHOLDING TAX RETURN (Form A1-QRT)

Businesses required to file quarterly withholding tax with the state of Arizona can do so using a form A1-QRT. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Quarterly Withholding Tax Return A1-QRT Step 1: At the top right-hand corner, enter your employer identification number and the quarter and year for which you are filing.

Arizona Quarterly Withholding Tax Return A1-QRT Step 2: In Section I, "Taxpayer Information," enter your business name, address, city, state, town, zip code and business telephone number.

Arizona Quarterly Withholding Tax Return A1-QRT Step 3: Check the boxes where indicated if filing an amended return, a final return canceling your tax account, or one documenting a change in address. If filing a final return, enter the date on which final wages were paid.

Arizona Quarterly Withholding Tax Return A1-QRT Step 4: Enter the total sum of your Arizona payroll this quarter.

Arizona Quarterly Withholding Tax Return A1-QRT Step 5: In section II, you must enter your tax liability. If filing on a quarterly tax liability basis, enter this in section A. If filing on a daily tax liability basis, you must complete the schedule on the second page 2.

Arizona Quarterly Withholding Tax Return A1-QRT Step 6: On line 1 of section III, enter your liability from section II.

Arizona Quarterly Withholding Tax Return A1-QRT Step 7: On line 2, enter the sum of payments already made for this quarter.

Arizona Quarterly Withholding Tax Return A1-QRT Step 8: Subtract line 2 from line 1. Enter the resulting difference on line 3.

Arizona Quarterly Withholding Tax Return A1-QRT Step 9: The taxpayer should sign and date the form, as well as providing their business telephone number.

Arizona Quarterly Withholding Tax Return A1-QRT Step 10: Any paid preparer who has completed the document should sign and date the form and provide their employer identification number, personal tax identification number or Social Security number. They should also enter the name of their firm, if applicable, its address and telephone number, and its employer identification or Social Security number.

Arizona Quarterly Withholding Tax Return A1-QRT Step 11: Any check submitted with payment should be made out to the "Arizona Department of Revenue," and include your employer identification number.