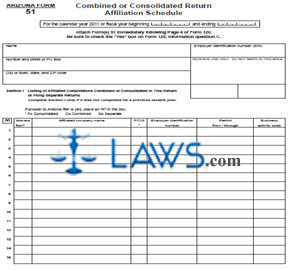

Form 51 Combined or Consolidated Return Affiliation Schedule

INSTRUCTIONS: ARIZONA COMBINED OR CONSOLIDATED RETURN AFFILIATION SCHEDULE (Form 51)

Corporations operating in Arizona use form 51 as a combined or consolidated return affiliation schedule. This is filed along with form 120. Both documents can be obtained from the website of the Arizona Department of Revenue.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 2: Enter your name in the first blank box.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 3: Enter your employer identification number in the second blank box.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 4: Enter your street number or PO box in the third blank box.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 5: Enter your city or town, state and zip code in the fourth blank box.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 6: Section 1 requires you to list affiliated corporations combined or consolidated in this return or filing separate returns. Indicate whether they are an Arizona filer in the first column.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 7: Enter the affiliated company name in the second column.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 8: In the third column, enter "F" if the company is consolidated, "C" if the company is combined or "S" if the company is separate.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 9: Enter the employer identification number in the fourth column.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 10: Enter the beginning and ending dates of the period in the fifth column.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 11: Enter the company's business activity code in the sixth column.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 12: Enter your name and tax identification number at the top of the second page.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 13: In Section II, document corporations added to the affiliated group during the taxable year as instructed.

Arizona Combined Or Consolidated Return Affiliation Schedule 51 Step 14: In Section III, document corporations deleted from the affiliated group during the taxable year as instructed.