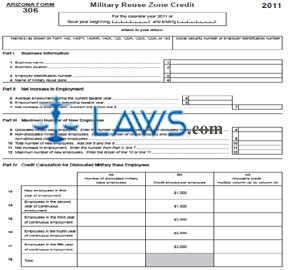

Form 306 Military Reuse Zone Credit

INSTRUCTIONS: ARIZONA MILITARY REUSE ZONE CREDIT (Form 306)

A form 306 is used in Arizona to claim credit for operating in a military reuse zone. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Military Reuse Zone Credit 306 Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Military Reuse Zone Credit 306 Step 2: Enter your name as it appears on form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165 in the first blank box.

Arizona Military Reuse Zone Credit 306 Step 3: Enter your Social Security number or employer identification number in the second blank box.

Arizona Military Reuse Zone Credit 306 Step 4: Provide all information required about your business on lines 1 through 4 of Part I.

Arizona Military Reuse Zone Credit 306 Step 5: Follow the provided directions to document a net increase in employment on lines 5 through 7 of Part II.

Arizona Military Reuse Zone Credit 306 Step 6: Follow the provided directions to document the maximum number of new employees on lines 8 through 12 of Part III.

Arizona Military Reuse Zone Credit 306 Step 7: Calculate your credit for dislocated military base employees as instructed on lines 13 through 18 of the table provided in Part IV.

Arizona Military Reuse Zone Credit 306 Step 8: Calculate your credit for non-dislocated military base employees as instructed on lines 19 through 24 of the table provided in Part V.

Arizona Military Reuse Zone Credit 306 Step 9: Lines 25 through 29 of Part VI are for the completion of S corporations only.

Arizona Military Reuse Zone Credit 306 Step 10: Lines 30 through 33 of Part VII document each partner's share of the credit. This section must be completed separately for documentation of each partner.

Arizona Military Reuse Zone Credit 306 Step 11: Part VIII concerns carryover of available credit. Complete lines 34 through 40 on the table provided as instructed.

Arizona Military Reuse Zone Credit 306 Step 12: Part IX concerns your total available credit. Enter your current year's credit for dislocated military base employees on line 41, the current year's credit for non-dislocated military base employees on line 42, your available credit carryover on line 43 and the sum of lines 41 through 43 on line 44.