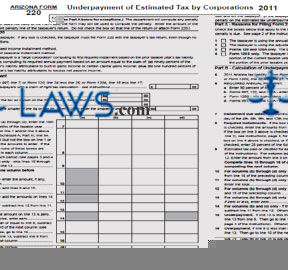

Form 220 Underpayment of Estimated Tax By Corporations

INSTRUCTIONS: ARIZONA UNDERPAYMENT OF ESTIMATED TAX BY CORPORATIONS (Form 220)

When corporations underpay their estimated Arizona tax, they calculate the underpayment and penalty owed using a form 220. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 1: If not filing for the calendar year printed on the form, print the beginning and ending dates of your fiscal year where indicated.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 2: In the first blank box, enter your name as it appears on form 99T, 120, 120A or 120S.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 3: In the third blank box, enter your employer identification number.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 4: Part A concerns your reasons for filing form 220. Check the box on line 1 if using the annualized income installment method.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 5: Check the box on line 2 if using the adjusted seasonal installment method.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 6: Check the box on line 3 only if you have completed form 120 or 120A and are a large corporation computing its first required installment based on the prior taxable year's tax liability.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 7: Check the box on line 4 only if you have completed form 120S and meet the requirements listed there.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 8: Part B concerns calculation of your underpayment. Enter your Arizona tax liability for the year in question on line 5.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 9: Complete lines 6 through 16 as instructed to calculate the amount of your overpayment or underpayment.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 10: At the top of the second page, enter your name and tax identification number.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 11: Part C concerns calculation of your penalty owed. Follow the directions on line 17 concerning the number to be used in association with the tax return you are filing.

Arizona Underpayment Of Estimated Tax By Corporations 220 Step 12: Complete lines 18 through 37 as instructed to compute your penalty owed.