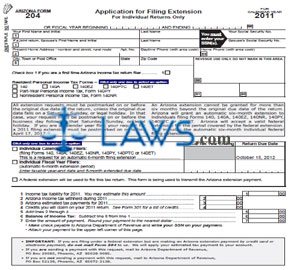

Form 204 Individual Income Application for Filing Extension

INSTRUCTIONS: ARIZONA APPLICATION FOR FILING EXTENSION FOR INDIVIDUAL RETURNS ONLY (Form 204)

Arizona residents who cannot complete their individual state tax returns by the due date may file a request for an extension. This form is available on the website of the Arizona Department of Revenue. This article discusses the document for tax year 2011.

Arizona Application For Filing Extension For Individual Returns Only 204 Step 1: At the top of the page, if you are filing on a fiscal year basis rather than on a calendar year basis, enter the starting and ending dates.

Arizona Application For Filing Extension For Individual Returns Only 204 Step 2: On line one, enter your first name, middle initial and last name, as well as your Social Security number. Those who file their taxes jointly should provide the same information for their spouse. On line two, provide your street address and daytime and home phone numbers, including area code. On line three, enter your city, state and zip code.

Arizona Application For Filing Extension For Individual Returns Only 204 Step 3: Check box one if you are filing an Arizona tax return for the first time.

Arizona Application For Filing Extension For Individual Returns Only 204 Step 4: Under "Resident Personal Income Tax Forms," check the box next to the type of return you will file. Below, indicate whether you are filing on a calendar or fiscal year basis. If the latter, enter the start and end dates. Check the box next to the statement below if you will be filing under a federal extension.

Arizona Application For Filing Extension For Individual Returns Only 204 Step 5: On line one, enter your income tax liability for 2011. You may estimate this amount. On lines two and three, note all state income tax withheld from your wages and estimated payments already submitted. On line four, note all credits you will claim. Total lines two through four and subtract them from line one to determine the balance of your tax due on line five.

Arizona Application For Filing Extension For Individual Returns Only 204 Step 6: On line seven, enter the amount of payment being submitted. You must pay at least 90% of your liability or interest and penalty fees will apply. Two addresses are given for those filing with and without a payment. Mail your form and any check to the applicable address.