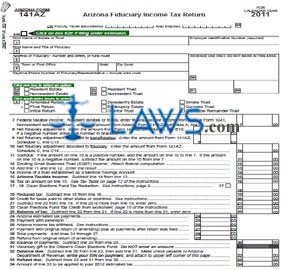

Form 141AZ Arizona Fiduciary Income Tax Return

INSTRUCTIONS: ARIZONA FIDUCIARY INCOME TAX RETURN (Form 141 AZ)

Fiduciaries of an Arizona estate or trust use a form 141 AZ to pay the related income tax. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Fiduciary Income Tax Return 141 AZ Step 1: If not filing for the calendar year pre-printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Fiduciary Income Tax Return 141 AZ Step 2: On line 1, enter the name of the estate or trust and its employer identification number.

Arizona Fiduciary Income Tax Return 141 AZ Step 3: On line 2, enter the name and title of the fiduciary.

Arizona Fiduciary Income Tax Return 141 AZ Step 4: On line 3, enter the street address or rural route of the fiduciary.

Arizona Fiduciary Income Tax Return 141 AZ Step 5: On line 4, enter the city, town or post office, state and zip code of the fiduciary, and their daytime telephone number.

Arizona Fiduciary Income Tax Return 141 AZ Step 6: Indicate the type of estate or trust by checking the appropriate box on lines 5a through 5d and check all appropriate statements on line 6.

Arizona Fiduciary Income Tax Return 141 AZ Step 7: Enter your federal taxable income on line 7. Nonresident estates or trusts will first need to complete Schedule A on the second page to complete this line.

Arizona Fiduciary Income Tax Return 141 AZ Step 8: Skip to Schedule B on the second page. Complete this section, then transfer the value from line B10 there to line 8 on the first page.

Arizona Fiduciary Income Tax Return 141 AZ Step 9: Complete Schedule C on the second page in order to complete lines 9 and 10 on the first page.

Arizona Fiduciary Income Tax Return 141 AZ Step 10: Complete lines 11 through 34 as instructed.

Arizona Fiduciary Income Tax Return 141 AZ Step 11: Complete Schedule D on the third page if the estate or trust has nonresident beneficiaries.

Arizona Fiduciary Income Tax Return 141 AZ Step 12: Answer all questions in Schedule E on the fourth page.

Arizona Fiduciary Income Tax Return 141 AZ Step 13: Enter your signature and the date at the bottom of the fourth page.