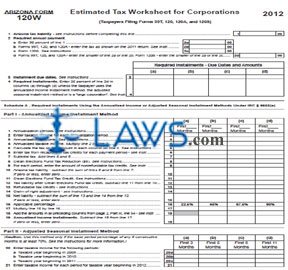

Form 120W Estimated Tax Worksheet for Corporations

INSTRUCTIONS: ARIZONA ESTIMATED TAX WORKSHEET FOR CORPORATIONS (Form 120W)

In Arizona, form 120W is used as a worksheet for corporations to calculate their estimated tax owed. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Estimated Tax Worksheet For Corporations 120W Step 1: On line 1, enter your Arizona tax liability.

Arizona Estimated Tax Worksheet For Corporations 120W Step 2: Lines 2a through 2d concern your required annual payment.

Arizona Estimated Tax Worksheet For Corporations 120W Step 3: Line 3 concerns your installation due dates. You will need to consult the separate instruction document for this form to provide this information.

Arizona Estimated Tax Worksheet For Corporations 120W Step 4: Line 4 concerns required installments.

Arizona Estimated Tax Worksheet For Corporations 120W Step 5: Part I is for the use of those using the annualized income installment method. Complete lines 1 through 7 as instructed to determine your tax subtotal.

Arizona Estimated Tax Worksheet For Corporations 120W Step 6: Complete lines 8 through 19 as instructed to determine your annualized income installments.

Arizona Estimated Tax Worksheet For Corporations 120W Step 7: Part II is for the use of those using the adjusted seasonal installment method. On lines 20a through 20c, enter your taxable income for the period listed on each line at the intervals specified in each column.

Arizona Estimated Tax Worksheet For Corporations 120W Step 8: On line 21, enter the taxable income for each period for the taxable year beginning in the calendar year printed on the page.

Arizona Estimated Tax Worksheet For Corporations 120W Step 9: On lines 22a through 22c, enter your taxable income for the period listed on each line at the intervals specified in each column.

Arizona Estimated Tax Worksheet For Corporations 120W Step 10: Complete lines 23 through 37 as instructed to determine the subtotal of your tax due.

Arizona Estimated Tax Worksheet For Corporations 120W Step 11: Completed lines 38 through 48 as instructed to determine your adjusted seasonal installments.

Arizona Estimated Tax Worksheet For Corporations 120W Step 12: Part III concerns required installments. On lines 49 through 54, column a concerns the first installment, column b concerns the second installment, column c concerns the third installment and column d concerns the fourth installment. Complete the table as instructed.