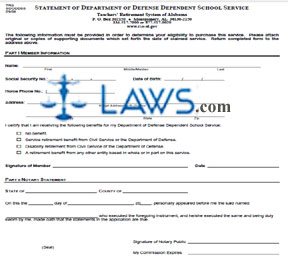

Department of Defense Dependent School Service

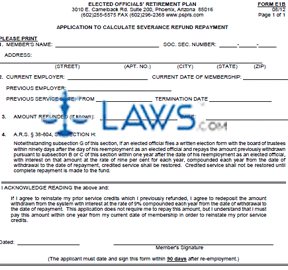

Form E1B: Election to Repay Severance Refund

INSTRUCTIONS: ARIZONA APPLICATION TO CALCULATE SEVERANCE FUND REPAYMENT (Form E1B)

Arizona elected officials enrolled in the state retirement fund who have contributed towards a severance fund can apply for a repayment using a form E1B if they regain employment with the state after being fired. This document can be obtained from the website maintained by the Elected Officials' Retirement Plan of the state of Arizona.

Arizona Application To Calculate Severance Fund Repayment E1B Step 1: On the first line of section 1, enter the member's name.

Arizona Application To Calculate Severance Fund Repayment E1B Step 2: On the second line of section 1, enter the member's Social Security number.

Arizona Application To Calculate Severance Fund Repayment E1B Step 3: On the third line of section 1, enter the member's street address, apartment number (if applicable), city, state and zip code.

Arizona Application To Calculate Severance Fund Repayment E1B Step 4: On the first line of section 2, enter the name of your current employer.

Arizona Application To Calculate Severance Fund Repayment E1B Step 5: On the second line of section 2, enter the current date of your membership.

Arizona Application To Calculate Severance Fund Repayment E1B Step 6: On the third line of section 2, enter the name of your previous employer.

Arizona Application To Calculate Severance Fund Repayment E1B Step 7: On the fourth line of section 2, enter the beginning service date of your previous employment.

Arizona Application To Calculate Severance Fund Repayment E1B Step 8: On the fifth line of section 2, enter the ending service date of your previous employment.

Arizona Application To Calculate Severance Fund Repayment E1B Step 9: On the first line of section 3, enter the amount refunded, if known.

Arizona Application To Calculate Severance Fund Repayment E1B Step 10: On the second line of section 3, enter the date of any such refund.

Arizona Application To Calculate Severance Fund Repayment E1B Step 11: On the first line of the last section, the date on which this form is being completed should be entered.

Arizona Application To Calculate Severance Fund Repayment E1B Step 12: On the second line of the last section, enter the member's signature.

Arizona Application To Calculate Severance Fund Repayment E1B Step 13: This form must be submitted within 90 days after re-employment is obtained. Repayment must be completed within a year to reinstate prior service credits.

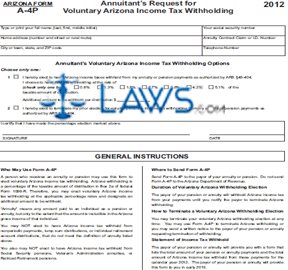

Form A-4P Annuitant’s Request For Voluntary Arizona Income Tax Withholdings

INSTRUCTIONS: ANNUITANT'S REQUEST FOR VOLUNTARY ARIZONA INCOME TAX WITHHOLDING (Form A-4P)

Arizona residents receiving an annuity or pension may elect to have income tax voluntary withheld from these funds. This can be done by filing a form A-4P. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 1: Type or print your last name, first name and middle initial in the first blank box.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 2: Enter your Social Security number in the second blank box.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 3: Enter your home street address in the third blank box.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 4: Enter your annuity contract claim or i.d. number in the fourth blank box.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 5: Enter your city or town, state and zip code in the fifth blank box.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 6: Enter your telephone number in the sixth blank box.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 7: Check the box on line 1 if electing to withhold income tax from your pension and annuity payments.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 8: Indicate with a check mark whether you wish for income tax to be withheld at the rate of 0.8%, 1.3%, 1.8%, 2.7%, 3.8%, 4.2% or 5.1%.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 9: If you wish for an additional amount of your distribution to be withheld, enter the dollar amount on the blank line.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 10: Check the box on line 2 if you are terminating a previously elected withholding.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 11: Enter your signature on the first blank line at the bottom of the page.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 12: Enter the date on the second blank line.

Annuitant's Request For Voluntary Arizona Income Tax Withholding A-4P Step 13: Send the form to the payor of your annuity or pension.

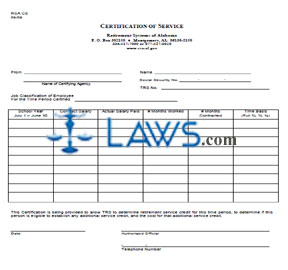

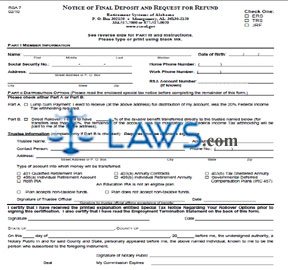

RSA 7, Notice of Final Deposit and Request for Refund

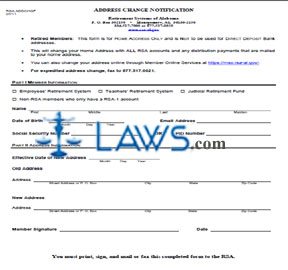

Address Change Notification

INSTRUCTIONS: ALABAMA ADDRESS CHANGE NOTIFICATION

Retired members enrolled with Alabama retirement systems must notify the agency if they change their home address. The form discussed in this article used to make this notification is found on the website of the Retirement Systems of Alabama. Note that this form is only used to document a change in your home address and cannot be used to change your direct deposit bank address. Note that rather than completing this form, you may change your registered home address online at the URL given at the top of the page. Additional assistance in completing this form can be obtained by calling the phone number also given at the top of the page.

Alabama Address Change Notification Step 1: Indicate with a check mark if you are enrolled in the Employees' Retirement System, Teachers' Retirement System, Judicial Retirement Fund, or if you are a non-RSA member with an RSA-1 account.

Alabama Address Change Notification Step 2: On the first line of Part I, enter your full name.

Alabama Address Change Notification Step 3: On the second line, enter your date of birth.

Alabama Address Change Notification Step 4: On the third line, enter your email address.

Alabama Address Change Notification Step 5: On the fourth line, enter your Social Security number. If you do not have one, enter your PID number instead.

Alabama Address Change Notification Step 6: Part II concerns your address. On the first line, enter the date on which your new address became effective.

Alabama Address Change Notification Step 7: On the second line, enter your full old address, including the street address or PO box, city, state and zip code.

Alabama Address Change Notification Step 8: On the third line, enter your complete new address, include the street address or PO box, city, state and zip code.

Alabama Address Change Notification Step 9: Sign and date the bottom of the form.

Alabama Address Change Notification Step 10: If you are filing this form through the mail, print it out and mail it to the address at the top of the page. Alternately, you may fax it to the number given there for expedited service.

Alabama Address Change Notification Step 11: Once the form has been processed, it will apply to all existing RSA accounts you have.

Form ERS 10MB Multiple Beneficiaries Attachment

INSTRUCTIONS: ALABAMA MULTIPLE BENEFICIARIES ATTACHMENT (Form ERS 10MB)

Alabama public employees enrolled in the state-administered employees' retirement system use the form discussed in this article to designate multiple beneficiaries who will receive their benefits in the event of the member's death. This document can be obtained from the website maintained by the Retirement Systems of Alabama.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 1: Enter the member's full name on the first blank line.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 2: Enter the member's Social Security number on the second blank line.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 3: In the table provided below, you may designate up to eight beneficiaries. Under Alabama law, in such cases benefits will be distributed evenly between all beneficiaries under the state's "joint survivorship" guidelines. In the first column, enter the first name, middle or maiden name and last name of each beneficiary.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 4: In the second column, enter the date of birth of each beneficiary.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 5: In the third column, enter the address of each beneficiary.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 6: In the fourth column, enter the relationship to you of each beneficiary.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 7: Check the box next to the first statement if the beneficiaries designated above are different from those on your active account and you wish to have the change take effect upon the submission of this signed and notarized application to the Employees' Retirement System.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 8: Check the box next to the second statement if the beneficiaries designated above are different from those on your active account and you wish to have the change take effect on the date of your retirement.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 9: Enter your signature on the next blank line.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 10: The form should then be certified by a notary public. They will enter the county, the date, their signature and the date on which their commission expires, as well as affixing their seal.

Alabama Multiple Beneficiaries Attachment ERS 10MB Step 11: File the form by mailing it to the address given at the top of the page.

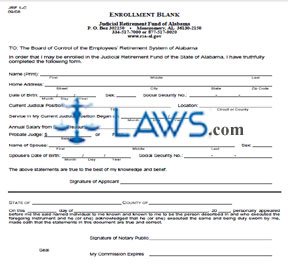

Form JRF 1-C Enrollment Blank

INSTRUCTIONS: ALABAMA ANNUAL INVESTMENT OPTION ELECTION DROP ROLLOVER OR 457 TRANSFER (Form RSA-1 IOE)

Alabama public employees enrolled in the state-administered RSA-1 delayed compensation retirement fund can use a form RSA-1 IOE to elect a DROP rollover or 457 transfer. This document can be obtained from the website of the Retirement Systems of Alabama.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 1: Enter your first name, middle or maiden name and last name on the first blank line.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 2: Enter your Social Security number on the second blank line.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 3: Enter your date of birth on the third blank line.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 4: If the member is deceased, enter the first name, middle name or maiden name and last name of the beneficiary on the fourth blank line, their Social Security number on the fifth blank line and their date of birth on the sixth blank line.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 5: On the next blank line, enter your street address or P.O. box number.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 6: On the next blank line, enter your city, state or zip code.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 7: On the next blank line, enter your email address.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 8: On the next blank line, enter your telephone number, including the area code.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 9: Indicate the type of election you are requesting by placing a check mark next to the appropriate statement.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 10: Enter the signature of the member or the beneficiary if the member is deceased on the next blank line and the date on the last blank line.

Alabama Annual Investment Option Election Drop Rollover Or 457 Transfer RSA-1 IOE Step 11: Have the form certified and signed by a notary public.