Annual Investment Option Election

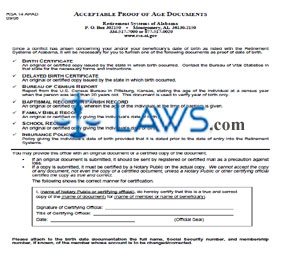

INSTRUCTIONS: ALABAMA ACCEPTABLE PROOF OF AGE DOCUMENTS (Form RSA 14 APAD)

When a conflict arises between the age of a retiree or their beneficiary as listed with the Retirement Systems of Alabama, it will be necessary for you to submit acceptable proof of age for yourself or the beneficiary. This documentation is discussed in form RSA 14 APAD, which can be found on the website of the Retirement Systems of Alabama.

Alabama Acceptable Proof Of Age Documents RSA 14 APAD Step 1: The first listed acceptable proof of age document is an original or certified copy of a birth certificate issued by the state in which birth took place.

Alabama Acceptable Proof Of Age Documents RSA 14 APAD Step 2: The second listed acceptable proof of age document is a delayed birth certificate form from the state in which birth occurred. Either the original or certified copy can be submitted.

Alabama Acceptable Proof Of Age Documents RSA 14 APAD Step 3: The third listed acceptable proof of age document is a bureau of census report stating the individual's age during a census year in which they were less than 20 years old. This document can only be used to establish the year of birth.

Alabama Acceptable Proof Of Age Documents RSA 14 APAD Step 4: The fourth listed acceptable proof of age document is a baptismal or parish record giving the age of the individual during their baptism. Either the original or a certified copy may be submitted.

Alabama Acceptable Proof Of Age Documents RSA 14 APAD Step 5: The fifth listed acceptable proof of age document is a family bible record in either its original form or as a certified copy.

Alabama Acceptable Proof Of Age Documents RSA 14 APAD Step 6: The sixth listed acceptable proof of age document is an original or certified school yard giving the individual's date of birth.

Alabama Acceptable Proof Of Age Documents RSA 14 APAD Step 7: The seventh listed acceptable proof of age document is an insurance policy giving the date of birth provided it is dated prior to enrollment in the Retirement Systems of Alabama.

Alabama Acceptable Proof Of Age Documents RSA 14 APAD Step 8: The bottom of the page provides instructions about obtaining proper certification and submitting your documentation.

INSTRUCTIONS: ALABAMA STATEMENT OF SERVICE (Form ERS SS)

To purchase credit for service for your retirement account as an Alabama public employee, file the document discussed in this article. This form can be obtained from the website of the Retirement Systems of Alabama.

Alabama Statement Of Service ERS SS Step 1: On the first blank line, enter your first name, middle name and last name.

Alabama Statement Of Service ERS SS Step 2: On the second blank line, enter your P.O. box number or street address.

Alabama Statement Of Service ERS SS Step 3: On the third blank line, enter your city, state and zip code.

Alabama Statement Of Service ERS SS Step 4: On the fourth blank line, enter your Social Security number.

Alabama Statement Of Service ERS SS Step 5: Check the box next to the first statement if you have not established credit with any other public retirement system for the service being claimed credit for with the Employees' Retirement System of Alabama. By checking this statement, you are agreeing to notify the Employees' Retirement System of Alabama if you become entitled to credit or benefits for the service being claimed with any other public retirement system at the time of your retirement. By checking this statement, you also agree that if you do receive credit or benefits for the service being claimed from any other public retirement system at the time of your retirement, the purchased service credit will be withdrawn and you will be refunded the fee paid for this credit.

Alabama Statement Of Service ERS SS Step 6: Check the box next to the second statement if you have established credit with another public retirement system for the service for which you are claiming credit with the Employees' Retirement System of Alabama.

Alabama Statement Of Service ERS SS Step 7: Enter your signature on the next blank line.

Alabama Statement Of Service ERS SS Step 8: Enter the date on the next blank line.

Alabama Statement Of Service ERS SS Step 9: The form should be certified by a notary public, who will affix their seal, enter their signature and provide the date on which their commission expires.

Alabama Statement Of Service ERS SS Step 10: Mail the form to the address given at the top of the page.

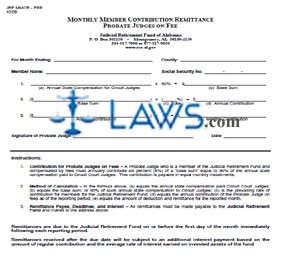

INSTRUCTIONS: ALABAMA MONTHLY MEMBER CONTRIBUTION REMITTANCE PROBATE JUDGES ON FEE (Form JRF MMCR – FEE)

Alabama probate judges compensated by fees who are members of the Judicial Retirement Fund must annually contribute 6% of their "base sum," which is defined as 90% of the annual state compensation paid to Circuit Court judges. These payments must be submitted on a monthly basis. The form used in such cases is discussed in this article and is available from the website maintained by the Retirement Systems of Alabama.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 1: On the first blank line, enter the end date of the month for which you are filing.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 2: On the second blank line, enter your county.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 3: On the third blank line, enter the member name.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 4: On the fourth blank line, enter your Social Security number.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 5: On line 1, enter the annual state compensation for circuit judges.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 6: Multiply the annual state compensation for circuit judges by .9. Enter the resulting product on line 1b. This is the "base sum."

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 7: On line 2, enter this base sum on the first blank line.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 8: Enter the monthly rate on line 2c. Multiply the base sum by the monthly rate and enter the resulting product on line 2d. This is your annual contribution.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 9: Transfer the annual contribution to line 3. Divide this by 12. Enter the resulting figure on line 2e. This is your monthly contribution.

Alabama Monthly Member Contribution Remittance Probate Judges On Fee JRM MMCR – FEE Step 10: Sign and date the bottom of the form.

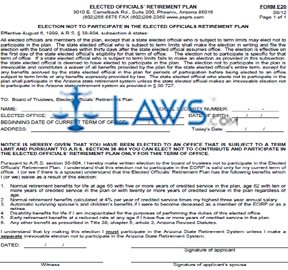

INSTRUCTIONS: ARIZONA ELECTION NOT TO PARTICIPATE IN THE ELECTED OFFICIALS' RETIREMENT PLAN (Form E20)

Arizona state elected officials with term limits can file a form E20 if they wish to elect not to participate in the states' elected officials' retirement plan. This document can be obtained from the website maintained by the Elected Officials' Retirement Plan of the State of Arizona.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 1: On the first line, enter your name.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 2: On the second line, enter your Social Security number.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 3: On the third line, enter the title of your elected office.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 4: On the fourth line, enter your date of birth.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 5: On the fifth line, enter the beginning date of your current date of office.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 6: On the sixth line, enter your address.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 7: On the seventh line, enter today's date.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 8: The first two paragraphs provide a general statement that you are making this election.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 9: Six numbered benefits you are waiving are listed below. By signing and dating the form, you are acknowledging this waiver.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 10: Enter the date on the first blank line on the bottom of the page.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 11: Sign the second blank line.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 12: A witness should print and sign their name in the third blank line.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 13: If the applicant has a spouse, their signature should be provided in the fourth blank line.

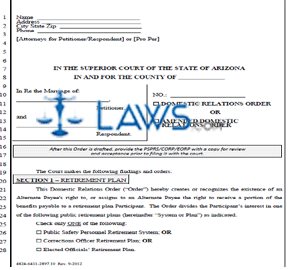

INSTRUCTIONS: ARIZONA DOMESTIC RELATIONS ORDER

To assign an alternate payee a portion of the benefits payable to an Arizona public safety personnel, corrections officer or elected official's retirement plan, a domestic relations order should be completed. This document can be obtained from the website maintained by those retirement plans.

Arizona Domestic Relations Order Step 1: Enter your name and address at the top of the form.

Arizona Domestic Relations Order Step 2: Enter the name of both spouses where indicated and your county.

Arizona Domestic Relations Order Step 3: In section 1, indicate your type of retirement plan with a check mark.

Arizona Domestic Relations Order Step 4: In section 2, indicate whether the participant in the plan is the plaintiff or respondent with a check mark. Give their address and date of birth.

Arizona Domestic Relations Order Step 5: In section 3, indicate whether the alternate payee is the plaintiff or respondent with a check mark. Give their address and date of birth.

Arizona Domestic Relations Order Step 6: In section 4, enter the date of marriage and the date on which community property interest ended.

Arizona Domestic Relations Order Step 7: Section 5 should only be completed if the participant has not yet retired or is not participating in the deferred retirement option plan.

Arizona Domestic Relations Order Step 8: Section 6 concerns division of monthly pension payments.

Arizona Domestic Relations Order Step 9: Section 7 concerns post-retirement benefit increases.

Arizona Domestic Relations Order Step 10: Section 8 should only be completed if the participant has not yet retired and/or is not a participation in the deferred retirement option plan.

Arizona Domestic Relations Order Step 11: Section 9 concerns employee contributions during participation in the deferred retirement option plan, if applicable.

Arizona Domestic Relations Order Step 12: Section 10 is optional and concerns disposition of the alternate payee's share in the event the alternate payee's death precedes that of the participant.

Arizona Domestic Relations Order Step 11: Sections 11 through 14 contain information about how this domestic relations order will take effect.

Arizona Domestic Relations Order Step 12: The judge of your superior court will sign and date the last page.

Arizona Domestic Relations Order Step 13: Both the participant and alternate payee should sign the last page.

INSTRUCTIONS: ALABAMA APPLICATION TO OBTAIN SERVICE CREDIT FOR MATERNITY LEAVE WITHOUT PAY

Members of the Alabama Employees' Retirement System can use the form discussed in this article to obtain service credit for maternity leave without pay. In order to be eligible to file this form, they must be an active member and contributing to the Employees' Retirement System at the time of purchase and must not have already received credit for this time with the program or any retirement plan other than Social Security. This document can be obtained from the website of the Employees' Retirement System of Alabama.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 1: On the first blank line, enter your first name, middle or maiden name, and last name.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 2: On the second blank line, enter your date of birth.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 3: On the third blank line, enter your Social Security number.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 4: On the fourth blank line, enter your street address or post office box number.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 5: On the fifth blank line, enter your city, state and zip code.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 6: On the sixth blank line, enter the name of your current employer.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 7: The bottom half of the form is to be completed by your employer. On the first and second blank lines of this section, they should enter the beginning and ending dates of your maternity leave without pay.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 8: On the third blank line, they should enter your employee job classification.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 9: On the fourth blank line, they should enter the name of the employing institution.

Alabama Application To Obtain Service Credit For Maternity Leave Without Pay Step 10: The certifying official should sign and date the form, as well as providing their official title.