Form RSA ADDCHGF Address Change Notification

INSTRUCTIONS: ALABAMA ADDRESS CHANGE NOTIFICATION (Form RSA ADDCHGF)

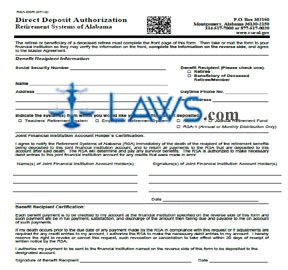

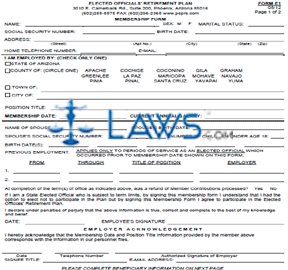

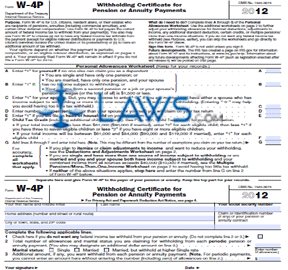

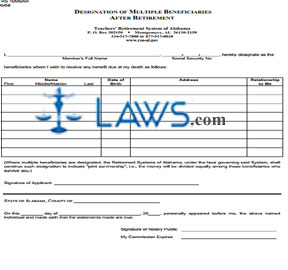

To change your registered home address with all Retirement Systems of Alabama accounts, use the form discussed in this article. This document can be obtained from the website maintained by the Retirement Systems of Alabama.

Alabama Address Change Notification RSA ADDCHGF Step 1: Part I concerns member information. Check the first box if enrolled in the Employees' Retirement system.

Alabama Address Change Notification RSA ADDCHGF Step 2: Check the second box if enrolled in the Teachers' Retirement System.

Alabama Address Change Notification RSA ADDCHGF Step 3: Check the third box if enrolled in the Judicial Retirement Fund.

Alabama Address Change Notification RSA ADDCHGF Step 4: Check the fourth box if a non-RSA member with an RSA-1 account.

Alabama Address Change Notification RSA ADDCHGF Step 5: On the first blank line, enter your first, middle, last and (if applicable) maiden name.

Alabama Address Change Notification RSA ADDCHGF Step 6: On the second blank line, enter your date of birth.

Alabama Address Change Notification RSA ADDCHGF Step 7: On the third blank line, enter your email address.

Alabama Address Change Notification RSA ADDCHGF Step 8: On the fourth blank line, enter your Social Security number. Alternately, enter your account (PID) number on the fifth blank line.

Alabama Address Change Notification RSA ADDCHGF Step 9: Part II concerns address information. Enter the effective date of your new address on the first blank line.

Alabama Address Change Notification RSA ADDCHGF Step 10: Enter your old street address or P.O. box number, city, state and zip code on the second blank line.

Alabama Address Change Notification RSA ADDCHGF Step 11: Enter your new street address or P.O. box number, city, state and zip code on the third blank line.

Alabama Address Change Notification RSA ADDCHGF Step 12: Enter your signature on the fourth blank line.

Alabama Address Change Notification RSA ADDCHGF Step 13: Enter the date on the fifth blank line.

Alabama Address Change Notification RSA ADDCHGF Step 14: Mail this form to the address given at the top of the page. You may also choose to complete and submit this form through Online Member Services at the URL given at the top of the page. For expedited service, fax the form to the number given at the top of the page.