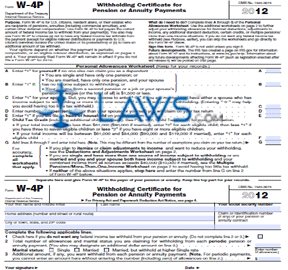

Form W-4P Withholding Certificate por Pension or Annuity Payments

INSTRUCTIONS: ARIZONA WITHHOLDING CERTIFICATE FOR PENSION OR ANNUITY PAYMENTS (Form W-4P)

To voluntarily withhold federal income tax from your Arizona pension or annuity payments, an IRS form W-4P should be filed. This documented can be obtained from the website maintained by the Internal Revenue Service.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 1: The top half of the page is a worksheet for your records only. On line A, enter "1" if no one else can claim you as a dependent.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 2: On line B, enter "1" if you meet any of the three criteria listed.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 3: On line C, enter "1" for your spouse, if applicable, unless your spouse has one or more source of income subject to withholding. In that case, you may wish to enter "0" to avoid underpaying.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 4: On line D, enter the number of dependents that will be claimed on your federal tax return.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 5: On line E, enter "1" if you are filing as head of household.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 6: Line F concerns your child tax credit, if applicable.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 7: Enter the total of lines A through F on line G.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 8: Detach the worksheet from the certificate.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 9: Enter your first name, middle initial and last name.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 10: Enter your Social Security number.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 11: Enter your home street address, city, state and zip code.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 12: Check box 1 if you do not want federal income tax withheld from your annuity or pension payments.

Arizona Withholding Certificate For Pension Or Annuity Payments W-4P Step 13: If you want to have federal income tax withheld, enter the total number of allowances and marital status being claimed for each payment on line 2. Enter any additional amount you want withheld on line 3.