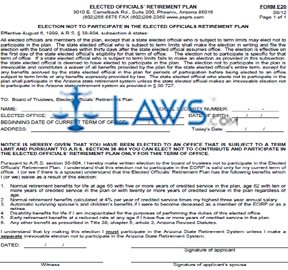

Form E20: Election not to Participate in the Elected Official’s Retirement Plan

INSTRUCTIONS: ARIZONA ELECTION NOT TO PARTICIPATE IN THE ELECTED OFFICIALS' RETIREMENT PLAN (Form E20)

Arizona state elected officials with term limits can file a form E20 if they wish to elect not to participate in the states' elected officials' retirement plan. This document can be obtained from the website maintained by the Elected Officials' Retirement Plan of the State of Arizona.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 1: On the first line, enter your name.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 2: On the second line, enter your Social Security number.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 3: On the third line, enter the title of your elected office.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 4: On the fourth line, enter your date of birth.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 5: On the fifth line, enter the beginning date of your current date of office.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 6: On the sixth line, enter your address.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 7: On the seventh line, enter today's date.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 8: The first two paragraphs provide a general statement that you are making this election.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 9: Six numbered benefits you are waiving are listed below. By signing and dating the form, you are acknowledging this waiver.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 10: Enter the date on the first blank line on the bottom of the page.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 11: Sign the second blank line.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 12: A witness should print and sign their name in the third blank line.

Arizona Election Not To Participate In The Elected Officials' Retirement Plan E20 Step 13: If the applicant has a spouse, their signature should be provided in the fourth blank line.