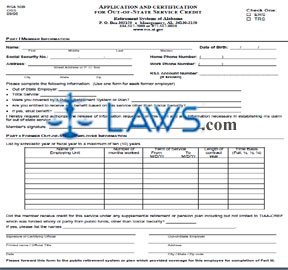

Request to Fax Account Information

INSTRUCTIONS: ALABAMA REQUEST TO FAX ACCOUNT INFORMATION

Members enrolled in Alabama government retirement systems may request that certain information about their account be faxed to them. This is done using the form discussed in this article, which can be obtained from the website of the Retirement Systems of Alabama.

Alabama Request To Fax Account Information Step 1: At the top of the page, enter either "Member Services" or the name of a specific agent towards whom this request is directed.

Alabama Request To Fax Account Information Step 2: In Part I, indicate with a check mark whether this request applies to an ERS, TRS, JRF, PEEHIP or RSA-1 account.

Alabama Request To Fax Account Information Step 3: On the first blank line of Part I, print your name.

Alabama Request To Fax Account Information Step 4: On the second blank line, enter the last 4 digits of your Social Security number. Alternately, you may enter your retirement or insurance account (PID) number.

Alabama Request To Fax Account Information Step 5: On the last blank line of this section, enter your contact phone number.

Alabama Request To Fax Account Information Step 6: In Part II, you must indicate the type of information you are requesting. Check the first box if requesting a verification of income and monthly benefits.

Alabama Request To Fax Account Information Step 7: Check the second box if requesting a certification of your retirement account balance.

Alabama Request To Fax Account Information Step 8: Check the third box if requesting a certification of DROP account balance.

Alabama Request To Fax Account Information Step 9: Check the fourth box if "other" and write the information you are requesting.

Alabama Request To Fax Account Information Step 10: Check the fifth box if you wish for a copy of your current year 1099R.

Alabama Request To Fax Account Information Step 11: Check the sixth box if you wish for a copy of a previous year's 1099R and enter the year.

Alabama Request To Fax Account Information Step 12: Enter the fax number to which this information should be faxed.

Alabama Request To Fax Account Information Step 13: Enter the name of the person who should be listed on the cover sheet and the company or business name if applicable.

Alabama Request To Fax Account Information Step 14: Enter your address if documenting a change of address.