Applying for DROP Distribution – Post DROP Termination

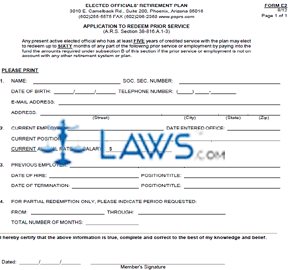

INSTRUCTIONS: ARIZONA APPLICATION TO REDEEM PRIOR SERVICE (Form E2)

Present active Arizona elected officials with at least five years of credited service within the state's retirement plan may redeem up to 60 months funds if your prior service or employment was not on account with any other retirement system or plan. This document can be obtained from the website maintained by the Elected Officials' Retirement Plan of the State of Arizona

Arizona Application To Redeem Prior Service E2 Step 1: On the first line of section 1, enter your name.

Arizona Application To Redeem Prior Service E2 Step 2: On the second line, enter your Social Security number.

Arizona Application To Redeem Prior Service E2 Step 3: On the third line, enter your date of birth.

Arizona Application To Redeem Prior Service E2 Step 4: On the fourth line, enter your telephone number.

Arizona Application To Redeem Prior Service E2 Step 5: On the fifth line, enter your email address.

Arizona Application To Redeem Prior Service E2 Step 6: On the sixth line, enter your complete address.

Arizona Application To Redeem Prior Service E2 Step 7: On the first line of section 2, enter the name of your current employer.

Arizona Application To Redeem Prior Service E2 Step 8: Enter the date you entered office on the second lien.

Arizona Application To Redeem Prior Service E2 Step 9: Enter your current position on the third line and your current annual salary rate on the fourth line.

Arizona Application To Redeem Prior Service E2 Step 10: On the first line of section 3, enter the name of your previous employer.

Arizona Application To Redeem Prior Service E2 Step 11: Enter the date of your hire on the second line and your position and title on the third line.

Arizona Application To Redeem Prior Service E2 Step 12: Enter the date of your termination on the fourth line and your position and title at that time on the fifth line.

Arizona Application To Redeem Prior Service E2 Step 13: Section 4 is only for those seeking partial redemption. Enter the beginning date of the first line.

Arizona Application To Redeem Prior Service E2 Step 14: Enter the ending date on the second line and the total number of months on the third line.

Arizona Application To Redeem Prior Service E2 Step 15: Sign and date the bottom of the page.

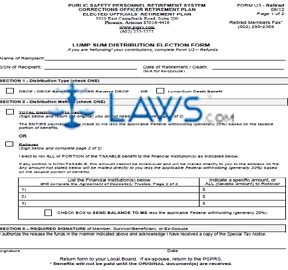

INSTRUCTIONS: ARIZONA LUMP SUM DISTRIBUTION ELECTION FORM (Form U3)

To elect to receive a lump sum distribution of funds in an Arizona retirement fund for elected officials, public safety personnel or corrections officers, file a form U3. This document can be obtained from the website maintained by these retirement systems.

Arizona Lump Sum Distribution Election Form U3 Step 1: On the first blank line, enter the name of the recipient.

Arizona Lump Sum Distribution Election Form U3 Step 2: On the second blank line, enter the Social Security number of the recipient.

Arizona Lump Sum Distribution Election Form U3 Step 3: On the third blank line, enter the date of the participant in the plan's retirement or death. This is not applicable if the form is being filed by an ex-spouse.

Arizona Lump Sum Distribution Election Form U3 Step 4: In section 1, check the first box if you are selecting a DROP, DROP beneficiary or CORP Reverse DROP election.

Arizona Lump Sum Distribution Election Form U3 Step 5: Check the second box if you are selecting a lump-sum death benefit.

Arizona Lump Sum Distribution Election Form U3 Step 5: In section 2, check the first box if you requesting total distribution to the recipient.

Arizona Lump Sum Distribution Election Form U3 Step 6: Check the second box if you are requesting a rollover. If so, you must list the financial institutions and the specific amount that will go to each as part of this rollover.

Arizona Lump Sum Distribution Election Form U3 Step 7: In section 3, enter your signature on the first blank line.

Arizona Lump Sum Distribution Election Form U3 Step 8: Enter the date on the second blank line.

Arizona Lump Sum Distribution Election Form U3 Step 9: The second page must be completed by every applicable financial institution if you are requesting a rollover. They should indicate your type of account with a check mark.

Arizona Lump Sum Distribution Election Form U3 Step 10: Your financial institution should enter the name of the account holder.

Arizona Lump Sum Distribution Election Form U3 Step 11: Your financial institution should enter your account number.

Arizona Lump Sum Distribution Election Form U3 Step 12: A financial institution representative should sign and date the form, as well as entering their mailing address.

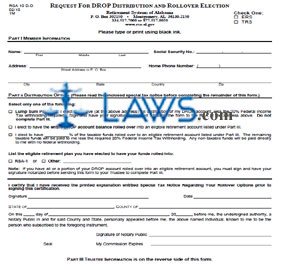

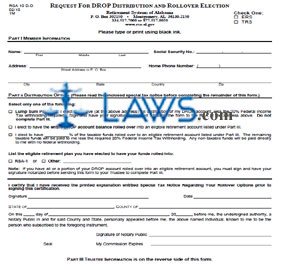

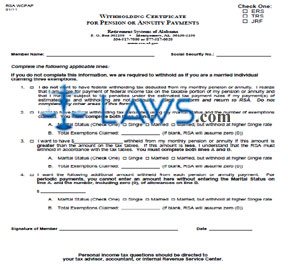

INSTRUCTIONS: ALABAMA REQUEST TO FAX ACCOUNT INFORMATION

Members enrolled in Alabama government retirement systems may request that certain information about their account be faxed to them. This is done using the form discussed in this article, which can be obtained from the website of the Retirement Systems of Alabama.

Alabama Request To Fax Account Information Step 1: At the top of the page, enter either "Member Services" or the name of a specific agent towards whom this request is directed.

Alabama Request To Fax Account Information Step 2: In Part I, indicate with a check mark whether this request applies to an ERS, TRS, JRF, PEEHIP or RSA-1 account.

Alabama Request To Fax Account Information Step 3: On the first blank line of Part I, print your name.

Alabama Request To Fax Account Information Step 4: On the second blank line, enter the last 4 digits of your Social Security number. Alternately, you may enter your retirement or insurance account (PID) number.

Alabama Request To Fax Account Information Step 5: On the last blank line of this section, enter your contact phone number.

Alabama Request To Fax Account Information Step 6: In Part II, you must indicate the type of information you are requesting. Check the first box if requesting a verification of income and monthly benefits.

Alabama Request To Fax Account Information Step 7: Check the second box if requesting a certification of your retirement account balance.

Alabama Request To Fax Account Information Step 8: Check the third box if requesting a certification of DROP account balance.

Alabama Request To Fax Account Information Step 9: Check the fourth box if "other" and write the information you are requesting.

Alabama Request To Fax Account Information Step 10: Check the fifth box if you wish for a copy of your current year 1099R.

Alabama Request To Fax Account Information Step 11: Check the sixth box if you wish for a copy of a previous year's 1099R and enter the year.

Alabama Request To Fax Account Information Step 12: Enter the fax number to which this information should be faxed.

Alabama Request To Fax Account Information Step 13: Enter the name of the person who should be listed on the cover sheet and the company or business name if applicable.

Alabama Request To Fax Account Information Step 14: Enter your address if documenting a change of address.

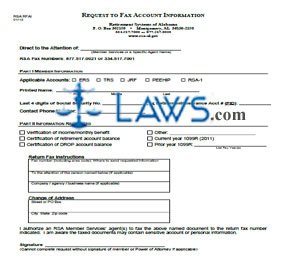

INSTRUCTIONS: ALABAMA TRANSFER OF MEMBERSHIP FROM EMPLOYEES' RETIREMENT SYSTEM (Form ERS TRF TR-2)

To transfer credit from the Alabama Employees' Retirement System to the state Teachers' Retirement System, use the form discussed in this article. This document can be obtained from the website maintained by the Retirement Systems of Alabama.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 1: Part I should be completed by you. On the first blank line, enter your first name, middle name, last name and maiden name.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 2: If the name under which you were employed is different from the above, enter it on the second blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 3: On the third blank line, enter your Social Security number.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 4: Enter your home street address or P.O. box number on the fourth blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 5: Enter your city, state and zip code on the fifth blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 6: Enter the name of your last employing Employees' Retirement System unit on the sixth blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 7: Enter the date of your last employment by this unit on the seventh blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 8: Enter the name of your present employing Teachers' Retirement System Unit on the eighth blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 9: Enter the date on which your present employment began on the ninth blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 10: Enter your signature on the tenth blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 11: Enter the date on the eleventh blank line.

Alabama Transfer Of Membership From Employees' Retirement System ERS TRF TR-2 Step 12: Part II should be completed by your last Employees' Retirement System employer. They should enter your total current year signature and their signature.