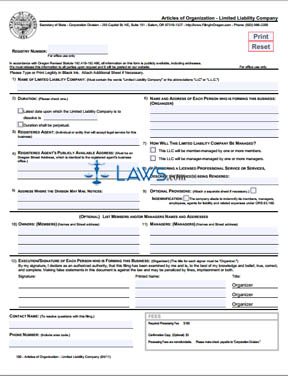

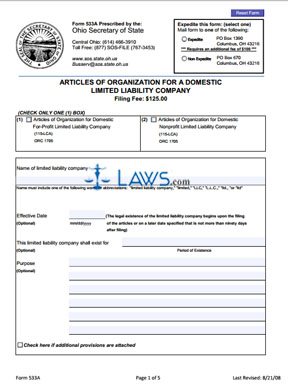

Form 533A Articles of Organization for a Domestic LLC

INSTRUCTIONS: ARTICLES OF ORGANIZATION FOR A DOMESTIC LLC

Use this form to begin the process of forming of profit or nonprofit limited liability company in Ohio. This form is easy to complete, but you should still consult with an attorney while completing this form and additional forms.

“Articles of Organization for a Domestic LLC Step 1”

Check the appropriate box at the top of the document. Check box 1 if the company is for-profit, or check box 2 if the company is nonprofit.

“Articles of Organization for a Domestic LLC Step 2”

Provide the name of the limited liability company in the next box. Make sure the name contains one of the following designations: limited liability company, limited, LLC, L.L.C., ltd., or ltd.

“Articles of Organization for a Domestic LLC Step 3”

If you want to extend the effective date after the Secretary of State approves the forms, enter a specific date in the next section no more than 90 days after the filing date. If the existence of the limited liability company is any less than perpetual, provide a period of existence below the effective date.

“Articles of Organization for a Domestic LLC Step 4”

Provide the purpose of the limited liability company at the bottom of the first page. This part is optional, but it’s still a good idea to include this information. If any additional provisions exist, check the box at the bottom of the first page and attach additional sheets.

“Articles of Organization for a Domestic LLC Step 5”

Make sure to complete the Original Appointment of Agent and Acceptance of Appointment on the second page. Provide the name and address of the statutory agent, and make sure they provide their signature at the bottom of the second page.

“Articles of Organization for a Domestic LLC Step 6”

At least one member has to sign the third page of this form.

“Articles of Organization for a Domestic LLC Step 7”

The filing fee for this form is $125.00. Expedited service will add $100 to the filing fee. If you want expedited service, use the following address:

Ohio Secretary of State

PO Box 1390

Columbus, OH 43216

If you want regular service, use the following address:

PO Box 670

Columbus, OH 43216