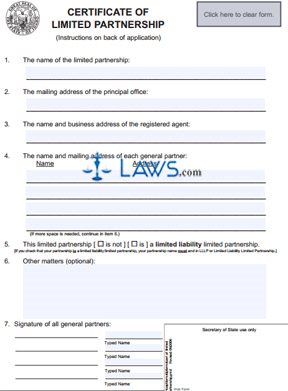

Form ID 230 Certificate of Limited Partnership

INSTRUCTIONS: CERTIFICATE OF LIMITED PARTNERSHIP ID 230

This form is required if a partnership is attempting to form within the state of Idaho. The filing party needs to provide their telephone number on the first line in the instructions in case there are any mistakes in the form. In order to avoid mistakes, consult with an attorney.

“Certificate of Limited Partnership ID 230 Step 1”

In Item 1, provide the name of the limited partnership. According to state code, the name of the limited partnership needs to have one of the following designations: limited partnership, L.P., or LP. If the partnership is a limited liability limited partnership, it needs either designation: Limited Liability Limited Partnership or LLLP.

“Certificate of Limited Partnership ID 230 Step 2”

List the mailing address for the principle office of the limited partnership in Item 2 of this form.

“Certificate of Limited Partnership ID 230 Step 3”

List the name and street address of the registered agent in Item 3. The registered agent must have residency in the state of Idaho and have a physical street address. The registered agent will receive any future service of process.

“Certificate of Limited Partnership ID 230 Step 4”

Provide the name and address for each general partner in Item 4. If additional space is needed, use Item 6 in this form.

“Certificate of Limited Partnership ID 230 Step 5”

Indicate if the company is a limited partnership or a limited liability limited partnership by checking the appropriate box in Item 5.

“Certificate of Limited Partnership ID 230 Step 6”

All general partners need to sign the bottom of this form. Make sure the name is printed beside the signature as well.

“Certificate of Limited Partnership ID 230 Step 7”

The filing fee is $100.00 if the application is typed. If there are attached pages and/or the application is not typed, the filing fee is $120.00. There is an additional filing fee of $20.00 if you ask for expedited service.

“Certificate of Limited Partnership ID 230 Step 8”

Make a copy of the completed form, and send in both sets along with the filing fee. Mail or deliver the documents to the following address:

Idaho Secretary of State

450 N 4th Street PO Box 83720

Boise, ID 83720-0080