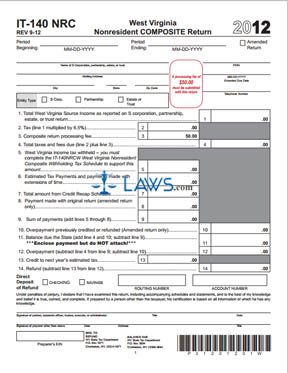

Form IT-140 NRC Non-Resident Composite Income Tax Return

INSTRUCTIONS: WEST VIRGINIA NONRESIDENT COMPOSITE INCOME TAX RETURN (Form IT-140 NRC)

Non-resident partnership partners, S-corporation shareholders or beneficiaries of a trust or estate deriving income from West Virginia can file a composite income tax return. The document can be found on the website of the West Virginia State Tax Department.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 1: Enter the beginning and ending dates of the period you are filing for.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 2: If this is an amended return, indicate this with a check mark.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 3: Enter the name of the S corporation, partnership, estate or trust and its mailing address, city, state and zip code.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 4: Indicate what type of entity you are filing for with a check mark.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 5: Enter your federal employer identification number and telephone number. If you previously received an extension, enter your extended due date.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 6: Enter your total West Virginia source income on line 1. Multiply this by 6.5% and enter the resulting product on line 2. This is your unadjusted tax owed.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 7: Add the $50 on line 3, which serve as the composite return processing fee, to line 2 and enter the resulting sum on line 4.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 8: You must complete the West Virginia Nonresident Composite Withholding Tax Schedule to complete line 5. This schedule documents all taxes withheld from wages and earnings.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 9: Complete lines 6 through 14 as directed to calculate your adjusted tax owed or refund due.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 10: If you wish to receive an anticipated refund as a direct deposit, indicate with a check mark whether the account in question is a savings or checking account. Provide your account and routing number.

West Virginia Nonresident Composite Income Tax Return IT-140 NRC Step 11: Sign and date the form, as well as providing your title.