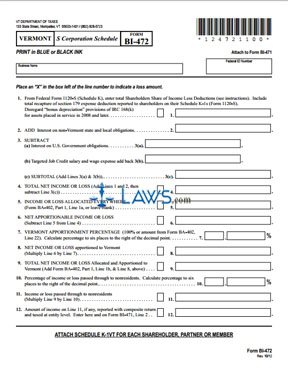

Form BI-472 S-Corporation Schedule

INSTRUCTIONS: VERMONT S CORPORATION SCHEDULE (Form BI-472)

A form BI-472 calculates the amount of income from a S corporation doing business in Vermont which is distributed to non-resident shareholders. This form is found on the website of the Vermont Department of Taxes.

Vermont S Corporation Schedule BI-472 Step 1: Enter your business name and federal identification number.

Vermont S Corporation Schedule BI-472 Step 2: On line 1, enter the total shareholders share of income less deductions.

Vermont S Corporation Schedule BI-472 Step 3: On line 2, enter your total interest on non-Vermont local and state obligations.

Vermont S Corporation Schedule BI-472 Step 4: On line 3a, enter your total interest on U.S. government obligations. On line 3b, enter your targeted job credit salary and wage expense. Add lines 3a and 3b and enter the resulting sum on line 3c.

Vermont S Corporation Schedule BI-472 Step 5: Add lines 1 and 2. Subtract line 3c from the resulting sum. Enter the difference on line 4.

Vermont S Corporation Schedule BI-472 Step 6: On line 5, enter your income or loss allocated everywhere.

Vermont S Corporation Schedule BI-472 Step 7: Subtract line 5 from line 4. Enter the resulting difference on line 6.

Vermont S Corporation Schedule BI-472 Step 8: On line 7, follow the instructions to calculate your Vermont apportionable percentage down to 6 decimal places.

Vermont S Corporation Schedule BI-472 Step 9: Multiply line 6 by line 7. Enter the resulting product on line 8.

Vermont S Corporation Schedule BI-472 Step 10: Enter your total net income or loss on line 9.

Vermont S Corporation Schedule BI-472 Step 11: On line 10, calculate the percentage of income or loss passed through to nonresidents down to six decimal places.

Vermont S Corporation Schedule BI-472 Step 12: Multiply line 9 by line 10. Enter the resulting product on line 11.

Vermont S Corporation Schedule BI-472 Step 13: On line 12, enter the amount of line 11 reported with a composite return and taxed at an entity level.

Vermont S Corporation Schedule BI-472 Step 14: When filing, you must attach a schedule K-1VT for every shareholder, member and partner.

Vermont S Corporation Schedule BI-472 Step 15: Mail the document to the address given in the instructions on the second page. Include a copy of the first four pages of form 1120S as they were filed with the Internal Revenue Service.