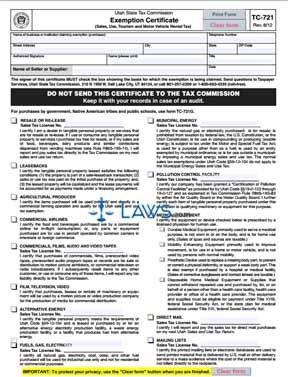

Form TC 721 Exemption Certificate

INSTRUCTIONS: UTAH EXEMPTION CERTIFICATE (Form TC-721)

Utah businesses which wish to claim an exemption from sales tax on a qualifying purchase should complete a form TC-721 and file it with the seller. This document can be obtained from the website of the Utah State Tax Commission.

Utah Exemption Certificate TC-721 Step 1: At the top of the form, enter the name of the business or institution filing for exemption.

Utah Exemption Certificate TC-721 Step 2: Provide the business address and telephone number.

Utah Exemption Certificate TC-721 Step 3: Provide the name, title and signature of an authorized business representative.

Utah Exemption Certificate TC-721 Step 4: Give the name of the seller and the date on which this form is being completed.

Utah Exemption Certificate TC-721 Step 5: The rest of the form lists qualifying exempt purchases. Check the box next to the statement which applies to this transaction. The first listed reason concerns purchases of items for resale or re-lease. Enter your sales tax license number.

Utah Exemption Certificate TC-721 Step 6: The next three reasons listed concern leasebacks, purchases made by agricultural producers, and purchases made by commercial airlines.

Utah Exemption Certificate TC-721 Step 7: The next listed reason concerns the purchase of commercials, films, and audio and video tapes.

Utah Exemption Certificate TC-721 Step 8: The next four listed reasons concern purchases of alternative energy, fuel, gas and electricity, municipal energy and purchases made by a pollution control facility. For all four, you must provide a sales tax license number.

Utah Exemption Certificate TC-721 Step 9: The next listed reason concerns purchases of medical equipment. You must additionally check the box to one of the four listed categories of medical equipment.

Utah Exemption Certificate TC-721 Step 10: The next two listed reasons concern purchases made by direct mail or of mailing lists. You must provide your sales tax license number.

Utah Exemption Certificate TC-721 Step 11: The next two listed reasons concern purchases of construction materials for out-of-state projects or for airports.

Utah Exemption Certificate TC-721 Step 12: The next listed reason concerns purchases of construction materials for religious and charitable organizations. Provide your organization's name, sales tax exemption number and the name of the project.

Utah Exemption Certificate TC-721 Step 13: Aside from purchases of locomotive fuel or tourism or motor vehicle rentals, all remaining listed reasons require you to give your sales tax license number.