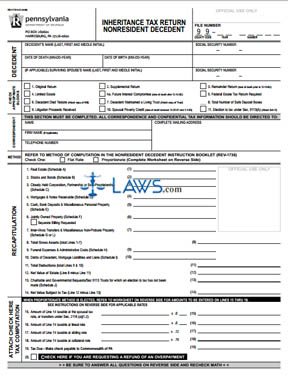

REV-1737-A Inheritance Tax Return Nonresident

INSTRUCTIONS: PENNSYLVANIA INHERITANCE TAX RETURN NONRESIDENT DECEDENT (Form REV-1737-A)

When a nonresident dies in Pennsylvania, inheritance tax owed to the state should be filed using a form REV-1737-A. This document can be obtained from the Pennsylvania commonwealth enterprise portal website, which maintains all government-related documents concerning the state.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 1: In the section marked "Decedent," provide the dead person's name, Social Security number, dates of death and birth, and the name and Social Security number of their surviving spouse if applicable.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 2: In the section marked "Check Appropriate Blocks," check the box next to all relevant statements concerning the return being filed.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 3: In the section marked "Correspondent," the person completing the document should provide their name, firm name (if applicable), telephone number and complete mailing address.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 4: In the section marked "Method," indicate with a check mark whether you have computed the tax owed using the flat rate or proportionate computation methods. If the latter, you will need to complete the "Proportionate Method Worksheet" on the second page.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 5: Lines 1 through 8 provide instructions for computing the estate's gross assets.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 6: Lines 9 through 11 provide instructions for computing the estate's total values. Subtract the value of line 11 from the value of line 8 and enter the difference on line 12 to determine the estate's net value.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 7: Complete lines 13 through 19 as instructed to determine the tax due. Check the box at the bottom of the page if requesting a refund related to overpayment.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 8: On the second page, enter the decedent's address in the space provided.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 9: Transfer the value of line 19 from the first page to line 1 on the second page.

Pennsylvania Inheritance Tax Return Nonresident Decedent REV-1737-A Step 10: Complete lines 2 through 5 as instructed to determine the adjusted balance due to the state. The person filing the return should sign and date the second page, as well as providing their address.