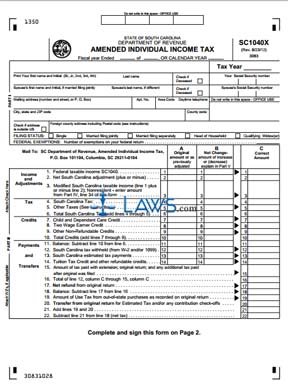

Form SC1040X Amended Individual Income Tax Return

INSTRUCTIONS: SOUTH CAROLINA AMENDED INDIVIDUAL INCOME TAX RETURN (Form SC1040X)

South Carolina individual residents who made an error on their initially filed tax return use a form SC1040X to file an amended return. This form is found on the website of the South Carolina Department of Revenue.

South Carolina Amended Individual Income Tax Return SC1040X Step 1: If you file on a fiscal year basis, enter the starting and ending dates at the top of the form. Otherwise, enter the calendar year for which you are filing.

South Carolina Amended Individual Income Tax Return SC1040X Step 2: At the top of the page, enter your name, address and Social Security number. If filing jointly with your spouse, give their name and Social Security number as well. Indicate with a check mark if you are single, married and filing jointly, married and filing separately, the head of a household, or a qualifying widow(er).

South Carolina Amended Individual Income Tax Return SC1040X Step 3: Enter the number of federal exemptions you are claiming.

South Carolina Amended Individual Income Tax Return SC1040X Step 4: Lines 1 through 14 require to enter your numbers as originally reported in Column A and the correct amount in Column B. Lines 1 through 3 concern income and adjustments.

South Carolina Amended Individual Income Tax Return SC1040X Step 5: Lines 4 through 6 concern South Carolina tax.

South Carolina Amended Individual Income Tax Return SC1040X Step 6: Lines 7 through 10 concern credits.

South Carolina Amended Individual Income Tax Return SC1040X Step 7: Lines 11 through 14 concern tax payments already made.

South Carolina Amended Individual Income Tax Return SC1040X Step 8: Lines 15 through 26 contain instructions for computing your tax or refund owed.

South Carolina Amended Individual Income Tax Return SC1040X Step 9: Sigh and date the bottom of the first page. If filing jointly, your spouse must sign and date the form as well.

South Carolina Amended Individual Income Tax Return SC1040X Step 10: Part IV on the second page is only to be completed by nonresidents.

South Carolina Amended Individual Income Tax Return SC1040X Step 11: In Part V, provide a detailed written explanation of each change. Include the line number for each change. Indicate with a check mark if you are or will be audited by the state or if you are filing due to a federal adjustment.