Form REV-1500 Inheritance Tax Return Resident

INSTRUCTIONS: PENNSYLVANIA INHERITANCE TAX RETURN RESIDENT DECEDENT (Form REV-1500)

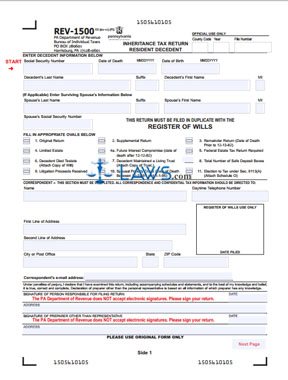

In Pennsylvania, inheritance tax owed can be filed using a form REV-1500. This document is found on the website of Pennsylvania's commonwealth enterprise portal, which houses all government documents related to the state.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 1: On the first page, enter the Social Security number and date of death of the decedent, as well as their date of birth, full name, and the Social Security number and name of their surviving spouse if applicable.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 2: Fill in the oval next to the appropriate statements below regarding the type of return being filed.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 3: In the section below, the person completing the document should give their name, daytime telephone number, address, and email address.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 4: Enter the decedent's name and address at the top of the second page.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 5: On lines 1 through 7, document the gross assets of the estate as instructed. Add the values on lines 1 through 7 and enter the sum on line 8.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 6: Document funeral expenses and administrative costs on line 9 and debts discharged from the estate on line 10. Total these deductions and enter the sum on line 11.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 7: Subtract line 11 from line 8. Enter the difference on line 12.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 8: In the case of trusts in which an election to tax has not been made, complete lines 13 and 14.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 9: Calculate the taxes due as instructed on lines 15 through 19. Fill in the oval on line 20 if requesting a refund of overpaid taxes.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 10: On the third page, enter the decedent's name and complete address.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 11: Below this, complete lines 1 through 5 as directed to determine the adjusted tax due.

Pennsylvania Inheritance Tax Return Resident Decedent REV-1500 Step 12: Answer all questions on the third page by checking "Yes" or "No" as applicable.