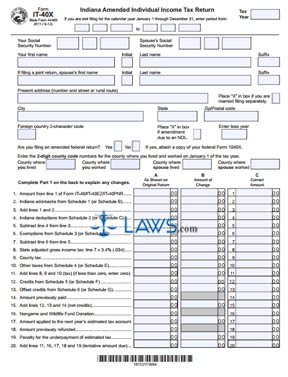

Form IT-40X Indiana Amended Individual Income Tax Return

INSTRUCTIONS: INDIANA AMENDED INDIVIDUAL INCOME TAX RETURN (Form IT-40X)

Indiana residents who need to file an amended income tax return do so with a form IT-40X. The state of Indiana maintains a website where all government forms for use in the state are available, including this one.

Indiana Amended Individual Income Tax Return IT-40X Step 1: At the top of the form, if you are not filing for a calendar year, give the starting and ending dates of your fiscal year. Otherwise, enter the tax year in question.

Indiana Amended Individual Income Tax Return IT-40X Step 2: Enter your Social Security number, name and address. If you file your taxes jointly with a spouse, include their Social Security number and name as well.

Indiana Amended Individual Income Tax Return IT-40X Step 3: If you are filing an amended federal return, note this with a check mark and attach a copy.

Indiana Amended Individual Income Tax Return IT-40X Step 4: Enter the 2-digit codes of the counties where you lived and worked in the year in question. Provide the same information for your spouse if applicable.

Indiana Amended Individual Income Tax Return IT-40X Step 5: Lines 1 through 16 require you to provide the figures entered on your original return in the first column, the change between your original and amended figures in the second column, and the amended figures in the third column. Lines 1 and 2 concern your state adjusted income and total exemptions.

Indiana Amended Individual Income Tax Return IT-40X Step 6: In lines 3 through 12, compute the tax due by following the instructions.

Indiana Amended Individual Income Tax Return IT-40X Step 7: In lines 13 through 20, compute your total credits.

Indiana Amended Individual Income Tax Return IT-40X Step 8: Compute any refund or interest and penalty owed on lines 21 through 25.

Indiana Amended Individual Income Tax Return IT-40X Step 9: Sign and date the form. If filing with your spouse, they must do the same. Enter your daytime telephone number and a contact email address.

Indiana Amended Individual Income Tax Return IT-40X Step 10: If you wish to authorize a personal representative to discuss your return with the Department of Revenue, give their name, address and telephone number where indicated. Any paid preparer must provide their name, address and identification number. At the bottom of the second page, explain all changes in detail.