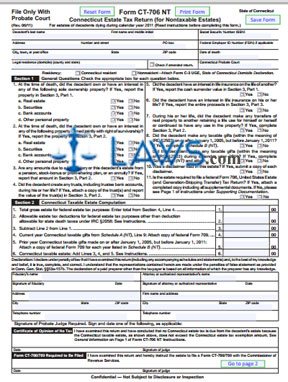

Form CT-706 NT Estate Tax Return for Nontaxable Estates

INSTRUCTIONS: CONNECTICUT ESTATE TAX RETURN (FOR NONTAXABLE ESTATES) (Form CT-706 NT)

A form CT-706 NT is filed with the applicable Connecticut probate court in the case of estates which are nontaxable after the death of a decedent. The document is found on the website of the government of Connecticut.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 1: At the top of the form, provide all identifying information requested about the decedent.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 2: Indicate with a check mark whether the decedent was a resident or a non resident. If the latter, attach a form C-3 UGE.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 3: Answer all the questions in Section 1 by checking "Yes" or "No" as applicable.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 4: Skip to Section 3 on the the second page. Document all solely-owned property in Part 1.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 5: Document jointly-owned property and property passing other than by will or laws of intestacy in Part 2.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 6: Enter all life insurance proceeds on the life of the decedent in Part 3.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 7: Total Parts 1 through 3 in Part 4 to calculate your total gross estate value as it would be valued on a federal estate tax return. Transfer the result to line 1 of Section 2 on the first page.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 8: Enter your allowable state deductions on line 2. Subtract line 2 from line 1 and enter the difference on line 3.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 9: Complete Schedule A (NT) on the fifth page to document current year Connecticut taxable gifts and transfer the results to line 4.

Connecticut Estate Tax Return (For Nontaxable Estates) CT-706 NT Step 10: Complete Schedule B (NT) on the sixth page to document prior year Connecticut taxable gifts made on or after January 1, 2005. Enter the total on line 5. Add lines 3 through 5 and enter the total on line 6. The fiduciary should sign and date the form and provide all requested identifying information.