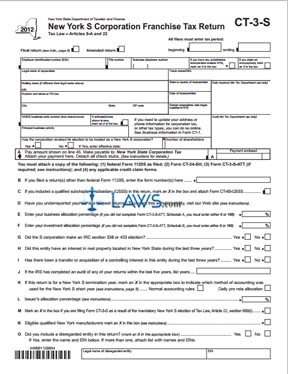

Form CT-3-S New York S Corporation Franchise Tax Return

INSTRUCTIONS: NEW YORK S CORPORATION FRANCHISE TAX RETURN (Form CT-3-S)

S Corporations doing business in New York must file their franchise taxes using a form CT-3-S. This can be used to submit an initial, amended or final return. The document is found on the website of the New York State Department of Taxation and Finance.

New York S Corporation Franchise Tax Return CT-3-S Step 1: Enter the beginning and ending dates of your filing period.

New York S Corporation Franchise Tax Return CT-3-S Step 2: Enter your employer identification number, file number, business telephone number and your corporation's legal name and trade DBA name.

New York S Corporation Franchise Tax Return CT-3-S Step 3: Enter your state or country of incorporation and the date of its incorporation. If you are a foreign corporation, give the date on which you began operating in New York.

New York S Corporation Franchise Tax Return CT-3-S Step 4: If your mailing name and address is different, enter it where indicated.

New York S Corporation Franchise Tax Return CT-3-S Step 5: Enter your NAICS code and a description of your principal business activity.

New York S Corporation Franchise Tax Return CT-3-S Step 6: Indicate if you have revoked your S corporation status. If so, give the date on which you did this.

New York S Corporation Franchise Tax Return CT-3-S Step 7: Enter the number of shareholders.

New York S Corporation Franchise Tax Return CT-3-S Step 8: Enter the amount of the payment enclosed on line A.

New York S Corporation Franchise Tax Return CT-3-S Step 9: Give all information requested in response to lines B through M.

New York S Corporation Franchise Tax Return CT-3-S Step 10: Lines 1 through 13 require you to transfer information from the corresponding lines on your federal form 1120S, Schedule K.

New York S Corporation Franchise Tax Return CT-3-S Step 11: Lines 14 through 21 require you to transfer information from the corresponding lines on your federal form 1120S, schedule M-2.

New York S Corporation Franchise Tax Return CT-3-S Step 12: Compute your taxes on lines 22 through 51.

New York S Corporation Franchise Tax Return CT-3-S Step 13: Indicate with a check mark if you are filing an amended return.

New York S Corporation Franchise Tax Return CT-3-S Step 14: An authorized representative should sign and date the form.