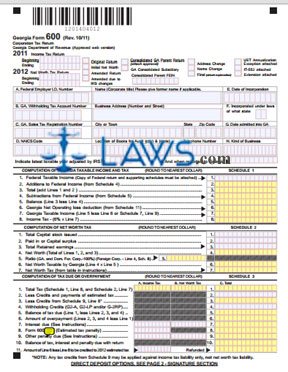

Form 600 Corporation Tax Return

INSTRUCTIONS: GEORGIA CORPORATION TAX RETURN (Form 600)

Corporations operating in Georgia can file their state income and net worth taxes owed by using a form 600. The document can be obtained from the website of the Georgia Department of Revenue.

Georgia Corporation Tax Return 600 Step 1: At the top of the form, give the dates for which you are filing and check the boxes next to all applicable statements about the return you are filing.

Georgia Corporation Tax Return 600 Step 2: In section A, give your federal employer identification number and corporate title name.

Georgia Corporation Tax Return 600 Step 3: In section B, give your your state withholding tax account number and business address.

Georgia Corporation Tax Return 600 Step 4: In section C, give your state sales tax registration number, city or town, state and zip code.

Georgia Corporation Tax Return 600 Step 5: In section D, give your NAICS code, the location of your books in case of an audit and a telephone number.

Georgia Corporation Tax Return 600 Step 6: In section E, give the date of your incorporation.

Georgia Corporation Tax Return 600 Step 7: In section F, give the state under whose laws you were incorporated.

Georgia Corporation Tax Return 600 Step 8: In section G, give the date under which you were admitted to practice in Georgia.

Georgia Corporation Tax Return 600 Step 9: In section H, describe your type of business.

Georgia Corporation Tax Return 600 Step 10: Write the last tax year whose return was filed by the IRS and the date of the last return filed with Georgia.

Georgia Corporation Tax Return 600 Step 11: Compute your state taxable income and tax due as instructed on lines 1 through 8 of Schedule 1. You will need to complete schedules 4 through 7 on the second page first.

Georgia Corporation Tax Return 600 Step 12: In Schedule 2, compute your net worth tax due as instructed on lines 1 through 7.

Georgia Corporation Tax Return 600 Step 13: In Schedule 3, compute your tax due or overpayment made on lines 1 through 11.

Georgia Corporation Tax Return 600 Step 14: If owed a refund you wish to receive through direct deposit, give your account information where indicated on the second page. An officer should sign and date the bottom of this page, as well as providing their title.