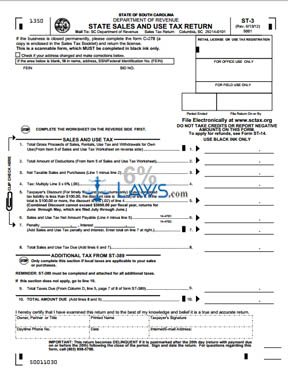

Form ST-3 State Sales and Use Tax Return

INSTRUCTIONS: SOUTH CAROLINA STATE SALES AND USE TAX RETURN (Form ST-3)

South Carolina businesses must regularly file a state sales and use tax return with the Department of Revenue. This form ST-3 can be found on the website of the state's Department of Revenue. The form should be filed electronically.

South Carolina State Sales And Use Tax Return ST-3 Step 1: At the top of the form, if you are filing a return concerning a business which has ceased operation, enter the date of closing and submit the form along with your license. On the right, enter your retail license or use tax registration number. Enter your name, address, and Social Security or Federal Employer Identification number below where indicated.

South Carolina State Sales And Use Tax Return ST-3 Step 2: Complete the worksheet on the reverse side of the page first. At the top of the page, enter your retail license or use tax registration number and the month and year of the end of the period for which you are filing.

South Carolina State Sales And Use Tax Return ST-3 Step 3: On line one, enter the total revenue from sales, rentals and any inventory withdrawn for personal use.

South Carolina State Sales And Use Tax Return ST-3 Step 4: On line two, enter the total of all purchases made out of state on which no sales tax was paid which are subject to use tax. Total lines one and two on line three. Enter the total on line one of the first page.

South Carolina State Sales And Use Tax Return ST-3 Step 5: Line four requires you to enter all exempt sales as detailed. Total these on line five, and subtract this sum from line three to determine your subtotal on line six.

South Carolina State Sales And Use Tax Return ST-3 Step 6: Line seven requires you to enter the total of all unprepared food sales, which are exempt from sales tax. Add this and line five. Enter the total here and also on line two of the first page. Subtract line eight from line three. Enter the total on line nine of the worksheet and line three of the first page.

South Carolina State Sales And Use Tax Return ST-3 Step 7: Return to the front page. Complete tax calculations as instructed on lines four through 10 to determine your total tax due.