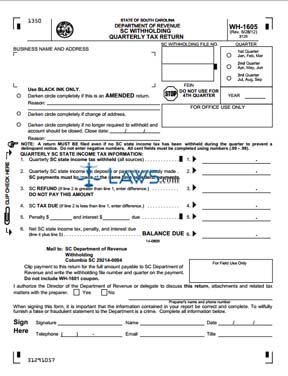

Form WH-1605 SC Withholding Quarterly Tax Return

INSTRUCTIONS: SC WITHHOLDING QUARTERLY TAX RETURN (Form WH-1605)

Businesses operating in South Carolina can use a form WH-1605 to document state taxes withheld from worker wages on a quarterly basis. This form is found on the website of the South Carolina Department of Revenue.

SC Withholding Quarterly Tax Return WH-1605 Step 1: Enter your business name and address where indicated.

SC Withholding Quarterly Tax Return WH-1605 Step 2: Enter your state withholding number and federal employer identification number. Indicate which quarter you are filing for by filling in the appropriate oval and enter the year.

SC Withholding Quarterly Tax Return WH-1605 Step 3: If you are filing an amended return, darken the oval where indicated and enter the reason.

SC Withholding Quarterly Tax Return WH-1605 Step 4: If you are filing a form documenting a change of address, darken the oval where indicated.

SC Withholding Quarterly Tax Return WH-1605 Step 5: If are filing a form if your account should be closed, give the closing date and provide a reason.

SC Withholding Quarterly Tax Return WH-1605 Step 6: Enter state income tax withheld on line 1.

SC Withholding Quarterly Tax Return WH-1605 Step 7: Enter all state income tax deposits or payments on line 2.

SC Withholding Quarterly Tax Return WH-1605 Step 8: If line 2 is greater than line 1, enter the resulting difference on line 3. This is the size of the refund you are entitled to.

SC Withholding Quarterly Tax Return WH-1605 Step 9: If line 1 is greater than line 1, enter the resulting difference on line 4. This is the amount of the tax you owe.

SC Withholding Quarterly Tax Return WH-1605 Step 10: If you are filing or paying late, calculate your penalty and interest owed on line 5.

SC Withholding Quarterly Tax Return WH-1605 Step 11: Enter the sum of lines 4 and 5 on line 6. This is your balance due.

SC Withholding Quarterly Tax Return WH-1605 Step 12: Sign and date the bottom of the page. Print your name and provide your title, as well as your telephone number and email address.

SC Withholding Quarterly Tax Return WH-1605 Step 13: If you wish to authorize a paid preparer to discuss this return with the state Department of Revenue, check the box where indicated and provide their name and telephone number.