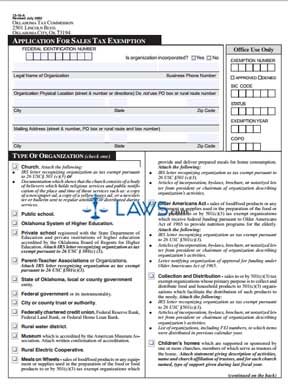

Form 13 16 A Application for Sales Tax Exemption

INSTRUCTIONS: OKLAHOMA APPLICATION FOR SALES TAX EXEMPTION (Form 13-16-A)

Qualifying Oklahoma entities can apply for an exemption from sales tax on purchases by filing a form 13-16-A with the state tax commission. This document can be found on their website. Note that all exempt purchases must be invoiced to the organization applying.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 1: At the top of the form, enter the federal identification number of your business. Note with a check mark whether or not your organization is incorporated.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 2: Give the legal name of your organization, its phone number, physical location and mailing address.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 3: The majority of the form lists the various qualifying organizations. You must check the box next to the statement which describes your organization and its exemption qualifications.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 4: The first listed organization is any type of church. You must attach a letter from the IRS attesting to your exemption status and documentation concerning your church's functions and attendees.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 5: The remainder of the reasons listed in the first column concern education entities, credit unions, government units and similar entities.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 6: Listed reasons in the second column include exemptions concerning the Older Americans Act, collection and distribution of goods to the needy, and children's homes. Note all documentation requirements listed.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 7: Listed reasons in the first column on the second page primarily concern children's organizations, health care and disabled veterans.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 8: Listed reasons in the second column primarily concern medical and cultural entities.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 9: An authorized representative of the organization should sign and print their name. If the organization is incorporated, this representative must be an officer.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 10: Enter the title of the authorized representative, their Social Security number and the date.

Oklahoma Application For Sales Tax Exemption 13-16-A Step 11: Submit the form to the address listed at the bottom of the second page along with all required documentation.