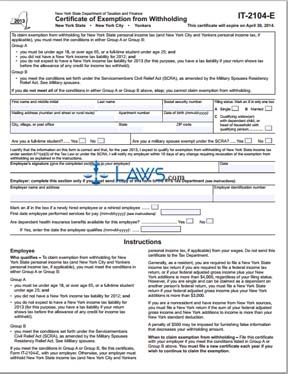

Form IT-2104-E Certificate of Exemption from Withholding

INSTRUCTIONS: NEW YORK CERTIFICATE OF EXEMPTION FROM WITHHOLDING (Form IT-2014-E)

To claim an exemption from withholding of wages for New York State personal income tax, you must meet the conditions outlined on form IT-2014-E. Group A covers those under 18 or over 65 or full-time students under age 25 with no state income tax liability for the tax year in question who do not expect to have a state income tax liability for the following tax year. Group B covers qualifying military spouses. This document must be filed to claim this exemption and can be obtained from the website maintained by the New York State Department of Finance and Taxation.

New York Certificate Of Exemption From Withholding IT-2014-E Step 1: In the first box, enter your first name, middle initial and last name.

New York Certificate Of Exemption From Withholding IT-2014-E Step 2: In the second box, enter your Social Security number.

New York Certificate Of Exemption From Withholding IT-2014-E Step 3: In the third box, enter your mailing street address.

New York Certificate Of Exemption From Withholding IT-2014-E Step 4: In the fourth box, enter your date of birth.

New York Certificate Of Exemption From Withholding IT-2014-E Step 5: In the fifth box, enter your city, village or post office, state and zip code.

New York Certificate Of Exemption From Withholding IT-2014-E Step 6: In the box on the right, indicate your filing status with a check mark.

New York Certificate Of Exemption From Withholding IT-2014-E Step 7: Indicate with a check mark whether you are a full time student.

New York Certificate Of Exemption From Withholding IT-2014-E Step 8: Indicate with a check mark whether you are a military spouse exempt under the Military Spouses Residency Relief Act (SCRA).

New York Certificate Of Exemption From Withholding IT-2014-E Step 9: Sign and date the top portion of the form.

New York Certificate Of Exemption From Withholding IT-2014-E Step 10: The bottom half of the form is only to be completed by your employer if they are required to send a copy to the New York State Tax Department. In the first box they will give their name and address, in the second box they will provide their employer identification number, and will answer all questions about your employment status as indicated.