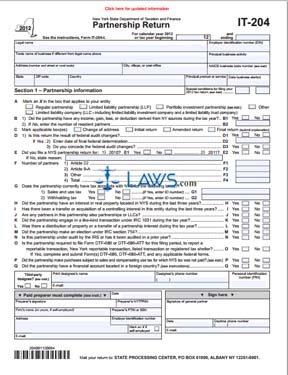

Form IT-204 Partnership Return

INSTRUCTIONS: NEW YORK PARTNERSHIP RETURN (Form IT-204)

Partnerships operating in New York should file a form IT-204 when filing their taxes. This document can be obtained from the website maintained by the New York State Department of Taxation and Finance.

New York Partnership Return IT-204 Step 1: If you are not filing for the fiscal year pre-printed on the form, enter the beginning and ending dates of your fiscal year.

New York Partnership Return IT-204 Step 2: Enter your legal name, employer identification number, trade name (if different from your legal name), principal business activity, address, NAICS code, country, principal product or service, and the date you began operations.

New York Partnership Return IT-204 Step 3: Section 1 requires you to provide information about your partnership. Complete lines A through Q as directed.

New York Partnership Return IT-204 Step 4: Section 2 concerns your federal business income or loss. Complete lines 1 through 26 as directed.

New York Partnership Return IT-204 Step 5: Section 3 concerns the cost of goods sold. Complete lines 27 through 39 as directed.

New York Partnership Return IT-204 Step 6: Section 4 concerns balance sheets per books. Document your assets on lines 40 through 57 as directed.

New York Partnership Return IT-204 Step 7: Document your liabilities and capital as directed on lines 58 through 65 as directed.

New York Partnership Return IT-204 Step 8: Section 5 concerns reconciliation of your income or loss per books with your income or loss per your return. Complete lines 66 through 74 as directed.

New York Partnership Return IT-204 Step 9: Section 6 concerns partners' capital accounts. Complete lines 75 through 85 as directed.

New York Partnership Return IT-204 Step 10: Section 7 concerns partners' share of income, deductions and other distributive share items. Complete lines 86 through 106 as directed.

New York Partnership Return IT-204 Step 11: Section 8 concerns New York modifications. Complete lines 107 through 115 as directed.

New York Partnership Return IT-204 Step 12: Section 9 concerns miscellaneous other information. Complete lines 116 and 117 as directed.

New York Partnership Return IT-204 Step 13: Section 10 is the New York allocation schedule. Complete lines 118 through 126 as directed.

New York Partnership Return IT-204 Step 14: Section 11 concerns partners' credit information. Complete lines 127 through 148f as directed.