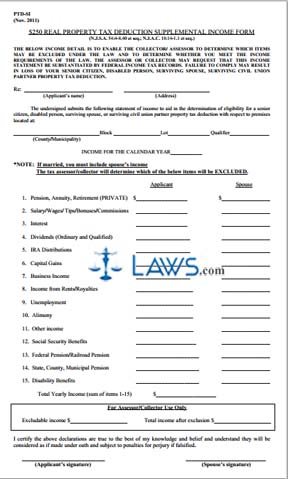

Form PTD-SI 250 Real Property Tax Deduction Supplemental Income

INSTRUCTIONS: NEW JERSEY $250 REAL PROPERTY TAX DEDUCTION SUPPLEMENTAL INCOME FORM (Form PTD-SI)

New Jersey residents who are senior citizens, permanently disabled, widows or widowers or survivors of a civil union may apply for a $250 deduction for their real property tax assessment by filing a form PTD-SI. This document is used by the municipal assessor in your area to determine which parts of your property qualify for exemption and whether you meet the income requirements for this exemption. The form can be found on the website of the state of New Jersey on the section maintained by the treasurer.

New Jersey $250 Real Property Tax Deduction Supplemental Income Form PTD-SI Step 1: Where indicated, enter your name and address. Enter the county or municipality in which you are filing, the block and lot number, and the qualifier. Enter your income for the calendar year in question.

New Jersey $250 Real Property Tax Deduction Supplemental Income Form PTD-SI Step 2: If you are married, you must submit all information for both you and your spouse.

New Jersey $250 Real Property Tax Deduction Supplemental Income Form PTD-SI Step 3: On line one, enter the value of all private pension, annuity and retirement funds.

New Jersey $250 Real Property Tax Deduction Supplemental Income Form PTD-SI Step 4: On line two, enter the total of all salary, wages, tips, commissions and bonuses.

New Jersey $250 Real Property Tax Deduction Supplemental Income Form PTD-SI Step 5: On line three, enter all income earned from interest. On line four, enter all income from dividends. On line five, enter all income from IRA distributions. On line six, enter all income from capital gains.

New Jersey $250 Real Property Tax Deduction Supplemental Income Form PTD-SI Step 6: On line seven, enter all business income. On line eight, enter all money from rent collected or royalties paid.

New Jersey $250 Real Property Tax Deduction Supplemental Income Form PTD-SI Step 7: On line nine, enter all unemployment benefits. On line 10, enter all alimony. On line 11, enter all other income. Lines 12 through 15 concern Social Security benefits, federal or railroad pensions, state/county/municipal pensions and disability benefits.

New Jersey $250 Real Property Tax Deduction Supplemental Income Form PTD-SI Step 8: Total lines one through 15. Sign the bottom of the form. Your spouse, if any, should do the same.