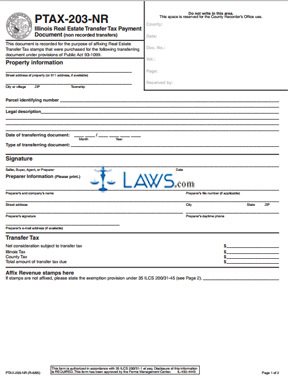

Form PTAX-203 NR Real Estate Transfer Tax Payment Document

INSTRUCTIONS: ILLINOIS REAL ESTATE TRANSFER TAX PAYMENT DOCUMENT (NON RECORDED TRANSFERS) (Form PTAX-203-NR)

Most Illinois real estate transfers require a PTAX-203-NR to be filed by either the seller, buyer, their agent or a paid preparer. Exemptions to this requirement are listed on the second page of this document. The form can be found on the website of the Illinois Department of Revenue.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 1: Under "Property Information," give the address of the property in question.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 2: Enter the parcel identifying number.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 3: Enter a legal description of the property.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 4: Give the month and year of the transferring document.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 5: Specify the type of transferring document.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 6: Under "Transfer Tax," enter the net consideration property value subject to transfer tax, the Illinois tax, the tax assessed by the county in which the property is located, and the total transfer tax due.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 7: Affix the Real Estate Transfer Tax stamps issued during the transaction. If none, you must provide a written explanation of why the transaction is exempt. Transactions which are exempt include tax deeds, deeds or trust documents whose actual consideration value is $100 or less, deeds of partition, deeds or trust documents securing a debt obligation, deads or trust documents related to government owned property, or deeds and trust documents made pursuant to mergers.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 8: The person filing the form must sign their name and give the date.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 9: If the form was completed by a paid preparer, they must print their name, file number if applicable, the name of their company, their address, daytime telephone number and email address. The preparer should also give their signature.

Illinois Real Estate Transfer Tax Payment (Non Recorded Transfers) PTAX-203-NR Step 10: File the document with the office of your county recorder.