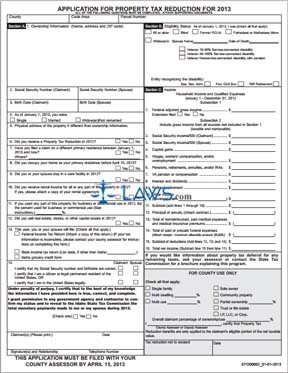

Form Application for Property Tax Reduction for 2012

INSTRUCTIONS: IDAHO APPLICATION FOR PROPERTY TAX REDUCTION FOR 2012

Idaho residents residing in houses or mobile homes whose household income does not exceed $28,000 for the year may be eligible for a property tax reduction as long as they are 65 or older, disabled, blind, widowed or a widower, a former POW, a veteran with a disability 10% or more related to their service, or veterans receiving a military pension for a non-service-related disability. This form must be filed with a copy of your federal income tax return, documents detailing income not shown on your tax return, a federal Schedule A or completed medical expense form, proof of payment for nonreimbursed medical expenses, and proof of payment or prepayment for funerals. This document can be found on the website of the Idaho Tax Commission.

Idaho Application For Property Tax Reduction For 2012 Step 1: At the top of the page, enter the county you are filing in, the code area, and the parcel number of the property in question.

Idaho Application For Property Tax Reduction For 2012 Step 2: Question 1 of section A asks for the name and address of the property owner. Question 2 asks for your Social Security number and question 3 asks for your birth date. If you file your taxes jointly with your spouse, include their information here as well. Question 4 asks if you are single, married or a widow or widower. Question 5 asks for the physical address of the property if different from above. Questions 6 through 12 ask for various information about the property and its uses.

Idaho Application For Property Tax Reduction For 2012 Step 3: Question 13 asks you to indicate whether you will be filing a federal tax return, state income tax return, and/or an Idaho grocery credit form. Question 14 asks you to place check marks next to statements about the accuracy of your information and your residency status.

Idaho Application For Property Tax Reduction For 2012 Step 4: Section B requires you to place a check next to the statement accurately describing your eligibility.

Idaho Application For Property Tax Reduction For 2012 Step 5: Section C is a worksheet requiring you to detail your income.

Idaho Application For Property Tax Reduction For 2012 Step 6: Sign and date the page in the bottom left corner.