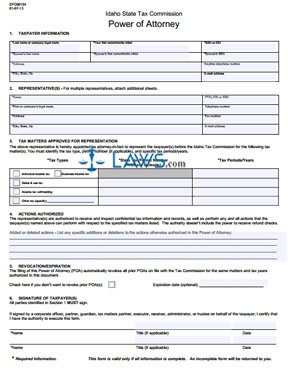

Form POA Power of Attorney

INSTRUCTIONS: IDAHO POWER OF ATTORNEY

A power of attorney form authorizes someone else to act on your behalf in a legally binding matter. The Idaho Power Of Attorney form discussed here specifically concerns tax matters regulated by the Idaho Tax Commission. The form is available on the website of the Idaho Tax Commission.

Power Of Attorney Step 1: In section 1, enter your name, address and Social Security Number or Employer Identification Number where indicated. If you are filing this form jointly with your spouse, they should do the same. Providing a daytime telephone number and email address is optional.

Power Of Attorney Step 2: In section 2, enter the name and address of the person you are designating as your representative. If you are authorizing a firm or business, you must provide their name. Including other contact information, or their Social Security Number or Employer Identification Number, is optional. If you wish to name more than person as your authorized representative, you must include additional forms with your application.

Power Of Attorney Step 3: In section 3, put a check mark next to the type of taxes you authorize them to represent you on, such as income or sales tax, and the years concerning these taxes which they are authorized to represent you during. You must include a state tax permit number if applicable.

Power Of Attorney Step 4: Section 4 states that these representatives can perform all the same actions as you concerning taxes except receiving states. You may restrict or expand their powers on the lines provided below.

Power Of Attorney Step 5: In section 5, list an expiration date if you desire. Otherwise, this authorization will continue indefinitely until you revoke it, become incapacitated or die. Submitting a power of attorney form will automatically revoke any you have submitted before unless you check the box indicating you wish for prior power of attorney forms to remain in effect. You must also attach all previous forms which you wish to remain in effect.

Power Of Attorney Step 6: Sign and date the form. If authorizing someone on behalf of an organization, note your job title.

Power Of Attorney Step 7: Mail or fax the completed document to the Idaho Tax Commission at the address listed in the instructions.