Form Annual Filing Report for Unclaimed Property 2011

INSTRUCTIONS: GEORGIA UNCLAIMED PROPERTY ANNUAL FILING REPORT

Georgia businesses in the possession of unclaimed property such as utilities deposits, checking and saving accounts and other unclaimed assets must attempt to restore them to the owner. When no owner can be found, the business must remit this unclaimed property to the state. This article discusses the form packet made available on the state's Department of Revenue website for government entities which must turn over unclaimed assets to the state.

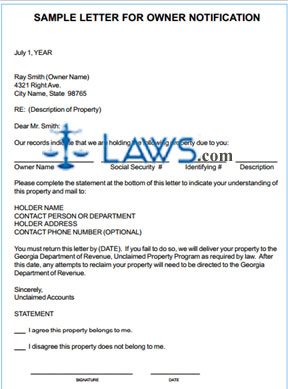

Georgia Unclaimed Property Annual Filing Report Step 1: The first form provided is a template for a sample letter that should be sent to owners to notify them of unclaimed assets. You may adjust your own letters as necessary. This form is not filed with the Department of Revenue and is for instructional purposes only.

Georgia Unclaimed Property Annual Filing Report Step 2: The second form provided is a holder report form (form UP-1G). You must identify the holder's name, federal employment identification number, address, and provide the name of a contact person, as well as their telephone number and email address. A responsible officer must print their name at the bottom, enter their title and the date, and provide their signature.

Georgia Unclaimed Property Annual Filing Report Step 3: The next form provided is an owner detail report form (form UP-2G). You can provide information for up to 25 unclaimed cash accounts on this form. This document is used to verify the identity of those laying a claim to such accounts.

Georgia Unclaimed Property Annual Filing Report Step 4: The next form is a zero/negative holder report form (form UP-1N). This document is filed if your entity has no unclaimed assets or property to report. If so, you must still file this document. Under "Holder Information," provide your business name, address, contact information, and all information requested about your assets and information.

Georgia Unclaimed Property Annual Filing Report Step 5: Under "Report Information," detail your intangible and other property.

Georgia Unclaimed Property Annual Filing Report Step 6: A responsible officer or their agent should sign and print their name at the bottom of this form, along with their title and the date.

Georgia Unclaimed Property Annual Filing Report Step 7: The last form is a holder reimbursement form, to be filed to obtain funds delivered to the state once holder claims forms have been processed.