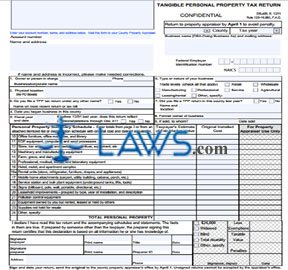

Form DR-405 Tangible Personal Property Tax Return

INSTRUCTIONS: FLORIDA PERSONAL PROPERTY TAX RETURN (Form DR-405)

Every Florida business must submit an annual return documenting all personal property used in its operations. This form DR-405 is found on the website of the Florida Department of Revenue and should be filed by April 1 to the property appraiser in your county in order to avoid having a penalty fee assessed.

Florida Personal Property Tax Return DR-405 Step 1: Give your name and address at the top of the page, as well as your Federal Employer Identification Number (FEIN) and the NAICS code assigned to your business.

Florida Personal Property Tax Return DR-405 Step 2: Section 1 asks for the name of the business owner and the name under which the company conducts business.

Florida Personal Property Tax Return DR-405 Step 3: Section 2 asks for the physical location of the business. Section 3 asks whether you file a tax return for this business under any other name.

Florida Personal Property Tax Return DR-405 Step 4: Section 4 asks on what day you began business in this county. Section 5 asks for the end date of your fiscal year.

Florida Personal Property Tax Return DR-405 Step 5: Section 6 concerns the nature of your business. Section 7 asks if you filed this return in this county the previous year. Section 8 asks for the name of the former owner, if any, while section 9 asks you to enter the date the property was sold and the name of the purchaser, if applicable.

Florida Personal Property Tax Return DR-405 Step 6: Sections 10 through 24 require you to detail the value of your personal property in the categories listed in their summary total. Give your estimation of their current fair market value and the original installation cost. Assets from sections 10 through 24 should be detailed on page two and have their total values transfered to the appropriate section.

Florida Personal Property Tax Return DR-405 Step 7: On the second page, detail all assets physically removed from your property in the last year, all leased, loaned or rented equipment in your possession and equipment you lease, loan or rent to others.

Florida Personal Property Tax Return DR-405 Step 8: The taxpayer must sign the first page, and provide their title, printed name and the date.