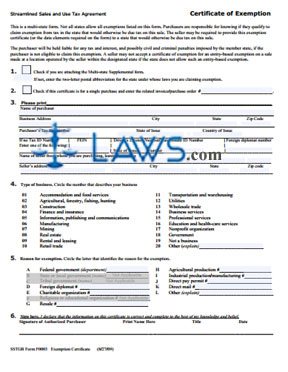

SST Certificate of Exemption F0003

INSTRUCTIONS: ARKANSAS STREAMLINED SALES AND USE TAX AGREEMENT CERTIFICATE OF EXEMPTION

Entities operating in multiple states who have a streamlined sales and use tax agreement in effect can file a certificate of exemption in Arkansas to document this status. This document can be obtained from the website maintained by the Arkansas Department of Finance and Administration.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 1: Check box 1 if you are attaching a multistate supplemental form or enter the two-letter abbreviation of the state under whose laws you are claiming an exemption.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 2: Check the box on line 2 if you are filing this certificate for a single purchase and enter the related purchase or invoice order number.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 3: Section 3 requires information about the purchaser. In the first box, enter the purchaser's name.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 4: In the second box, enter the purchaser's business address.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 5: In the third box, enter the purchaser's city.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 6: In the fourth box, enter the purchaser's state.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 7: In the fifth box, enter the purchaser's zip code.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 8: In the sixth box, enter the purchaser's tax ID number.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 9: In the seventh box, enter the tax ID number's state of issue.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 10: Enter the country of issue in the eighth box.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 11: If no tax ID, provide alternate identification as directed in the ninth box.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 12: Enter the name of the seller in the tenth box, and provide their address where indicated.

Arkansas Streamlined Sales And Use Tax Agreement Certificate Of Exemption Step 13: Complete sections 4 and 5 as directed. Sign and date section 6.