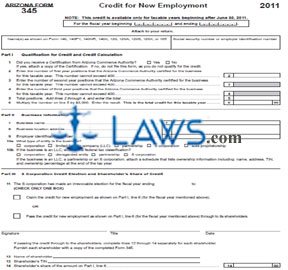

Form 345 Credit for New Employment

INSTRUCTIONS: ARIZONA CREDIT FOR NEW EMPLOYMENT (Form 345)

Arizona businesses claim a credit for creating new employment using a form 345. This document can be obtained from the website of the Arizona Department of Revenue. Further assistance can be obtained from a separate instruction booklet also made available on their website.

Arizona Credit For New Employment 345 Step 1: Enter the beginning and ending dates of your fiscal year at the top of the first page.

Arizona Credit For New Employment 345 Step 2: Enter your name or names as they appear on form 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165.

Arizona Credit For New Employment 345 Step 3: Enter your Social Security number or employer identification number.

Arizona Credit For New Employment 345 Step 4: Part I concerns your qualifications for credit and calculation of this credit. Complete lines 1 through 6 as instructed.

Arizona Credit For New Employment 345 Step 5: Part II concerns your business. Complete lines 7 through 10b as instructed.

Arizona Credit For New Employment 345 Step 6: Part III concerns S corporation credit election and shareholder's share of credit. Indicate whether you are claiming the credit for new employment or passing it along to shareholders with a check mark on line 11. If the latter, complete lines 12 through 14 separately for each shareholder.

Arizona Credit For New Employment 345 Step 7: Part IV concerns each partner's share of the credit. Complete lines 15 through 17 separately for each partner.

Arizona Credit For New Employment 345 Step 8: Part V requires you to document and calculate the available credit carryover. Complete lines 18 through 24 on the table provided as instructed.

Arizona Credit For New Employment 345 Step 9: Part VI concerns computation of the total available credit. Complete lines 25 through 27 as instructed.

Arizona Credit For New Employment 345 Step 10: The third page contains form 345-1. You must complete this form for each employee at the business location regardless of whether they are in a qualified employment position.

Arizona Credit For New Employment 345 Step 11: The fourth page contains form 345-2, which provides a table for documentation of all employees in qualified employment positions. If claiming more than 23 employees in qualified employment positions, complete additional schedules as necessary.