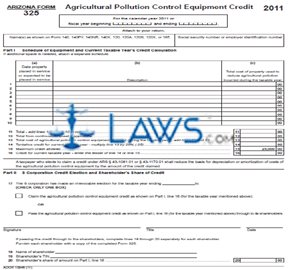

Form 325 Credit for Agricultural Pollution Control Equipment

INSTRUCTIONS: ARIZONA AGRICULTURAL POLLUTION CONTROL EQUIPMENT CREDIT (Form 325)

Arizona residents wishing to obtain tax credit for installing agricultural pollution control equipment do so by filing a form 325. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 1: If not filing for the calendar year pre-printed on the form, enter the beginning and ending dates of your fiscal year.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 2: Enter your name as it appears on your 140, 140PY, 140NR, 140X, 120, 120A, 120S, 120X or 165 tax return.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 3: Enter your Social Security number or employer identification number.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 4: Part I concerns equipment purchased and calculation of your current taxable year's credit. Enter the date the property was placed into service or is expected to be placed into service in column a, a description of the property in column b, and the total cost of this property in column C. Total the values in column c from lines 1 through 10 and enter the resulting sum on line 11.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 5: Complete lines 12 through 16 as directed to determine your credit for the current taxable year.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 6: Part II concerns S Corporation credit election and the shareholder's share of credit. Check the appropriate box in response to question 17.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 7: Sign and date the form where indicated and give your title.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 8: If passing the credit through to shareholders, complete lines 18 through 20. This section must be completed separately for each shareholder.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 9: Part III concerns the partner's share of the credit. Lines 21 through 23 must be completed separately for each partner.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 10: Part IV concerns computation of the available credit carryover.

Arizona Agricultural Pollution Control Equipment Credit 325 Step 11: Part V provides instructions for the calculation of your final total available credit. Individuals should transfer the final line to form 301, while corporations and S corporations should transfer it to form 300.