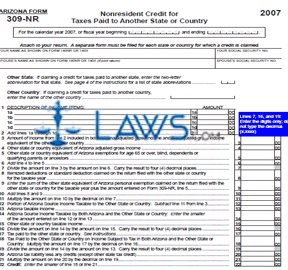

Form 309R Credit for Taxes Paid to Another State or Country

INSTRUCTIONS: ARIZONA RESIDENT CREDIT FOR TAXES PAID TO ANOTHER STATE OR COUNTRY (Form 309-R)

Arizona residents seeking credit for taxes paid to another state or country did so in 2007 by filing a form 309-R. This document can still be obtained from the website of the Arizona Department of Revenue.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 1: If not filing on a calendar year basis, enter the beginning and ending dates of your fiscal year.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 2: Enter your name as it appears on your form 140 or 140X.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 3: Enter your Social Security number.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 4: If you file your tax returns jointly, enter your spouse's name and Social Security number where indicated.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 5: If claiming credit for taxes paid to another state, enter its two-letter abbreviation.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 6: If claiming credit for taxes paid to another country, enter its full name.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 7: On lines 1a through 1d, list your income items and their respective values.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 8: Enter the sum of the values from lines 1a through 1d on line 2.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 9: Compute the portion of your out-of-state income taxable to Arizona as directed on lines 3 through 12. On line 7, the value entered should be rounded to the nearest whole number and should not contain decimals.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 10: Compute your Arizona taxable income as directed on lines 13 through 15. The value entered on line 13d should be rounded to the nearest whole number.

Arizona Resident Credit For Taxes Paid To Another State Or Country 309-R Step 11: Compute your Arizona credit as instructed on lines 16 through 20. The value entered on line 16 should be rounded to the nearest whole number