Form 01-5414 Office of Administrative Hearings Supplemental Power of Attorney

INSTRUCTIONS: ARIZONA OFFICE OF ADMINISTRATIVE HEARINGS SUPPLEMENTAL POWER OF ATTORNEY (Form 01-5414)

When a disputed matter has been transferred by the Arizona Department of Revenue to the Office of Administrative Hearings for a hearing, an appointee with power of attorney from the taxpayer must file a form 01-5414 certifying they are authorized to receive confidential information and conduct negotiations on behalf of their client. This document can be obtained from the website of the Arizona Department of Revenue.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 1: Section 1 requires that you give the name or names of the taxpayer, their daytime telephone number, and their complete home address.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 2: Section 2 requires you to provide the applicable identification number for the taxpayer. Enter their Arizona transaction privilege tax number, federal employer identification number or Social Security number as appropriate.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 3: In section 3, give the name, address, ID number, telephone number and fax number for up to two representatives.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 4: In section 4, indicate with check marks whether you are authorized regarding transaction privilege tax, use tax, or other. If the latter, specify. Indicate the type of entity you are representing with a check mark and enter the assigned case number.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 5: In section 5, enter any specific restrictions in your power of attorney.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 6: In section 6, indicate with a check mark whether notices and similar notifications should be sent only to the first-named representative or to both.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 7: Section 7 requires you to attach a copy of any Department of Revenue power of attorney.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 8: In section 8, one or both representatives must print and sign their name, enter their title and give the date.

Arizona Office Of Administrative Hearings Supplemental Power Of Attorney 01-5414 Step 9: Mail the completed form to the address at the bottom of the second page.

Application for Informal Probate and Appointment of Personal Representative

INSTRUCTIONS: MONTANA APPLICATION FOR INFORMAL PROBATE AND APPOINTMENT OF PERSONAL REPRESENTATIVE

This article discusses the application to be filed to be appointed as a personal representative in an informal Montana probate. This document can be obtained from the website maintained by the Montana Courts system.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 1: At the top lefthand corner, enter your name, address, phone number, and the name of the applicant.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 2: Enter the number of the judicial district court on the first blank line.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 3: Enter the name of the county on the second blank line.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 4: Enter the name of the deceased on the third blank line.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 5: Enter the probate number on the fourth blank line.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 6: On line 1, enter the relationship of the applicant to the deceased.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 7: On line 2, enter the date of death and the county in which death took place.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 8: In section 3, enter the names and addresses of the spouse, children, heirs and devisees, as well as the ages of those who are minors.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 9: In section 4, enter the name and address of the personal representative of the decedent whose appointment has not been terminated.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 10: Circle the appropriate statement in section 5.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 11: In section 7, enter the reason the applicant is entitled to be appointed as Personal Representative.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 12: On the first blank line of the second page, enter the date.

Montana Application For Informal Probate And Appointment Of Personal Representative Step 13: On the second blank line, enter your signature. Have the form certified by a notary public.

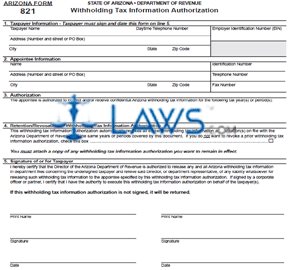

Form 821 Withholding Tax Information Authorization

INSTRUCTIONS: ARIZONA WITHHOLDING TAX INFORMATION AUTHORIZATION (Form 821)

If an Arizona taxpayer wishes to have a corporation, organization, firm or partnership authorized to receive confidential documentation and information regarding withholding taxes, they should file a form 821. Those wishing to authorize an individual must file a form 285-I. Both documents can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona Withholding Tax Information Authorization 821 Step 1: Section 1 requires information about the taxpayer. On the first line, enter your name, daytime telephone number and Arizona withholding tax number.

Arizona Withholding Tax Information Authorization 821 Step 2: On the second line, enter your street address and federal employer identification number.

Arizona Withholding Tax Information Authorization 821 Step 3: On the third line, enter your city, state, zip code and Social Security number.

Arizona Withholding Tax Information Authorization 821 Step 4: Section 2 requires information about the appointee. In the box on the left, enter the business entity name on the first line.

Arizona Withholding Tax Information Authorization 821 Step 5: Enter the street address, including any suite or apartment number, of the appointee on the second line in the box on the left.

Arizona Withholding Tax Information Authorization 821 Step 6: On the third line, enter the appointee's city, state and zip code.

Arizona Withholding Tax Information Authorization 821 Step 7: In the box on the right, enter their business ID number on the first line.

Arizona Withholding Tax Information Authorization 821 Step 8: On the second line, enter their telephone number, including the area code.

Arizona Withholding Tax Information Authorization 821 Step 9: On the third line, enter their fax number, including the area code.

Arizona Withholding Tax Information Authorization 821 Step 10: In section 3, give the year or period for which they are authorized to receive or inspect confidential information.

Arizona Withholding Tax Information Authorization 821 Step 11: Section 4 states that by filing this authorization, you are revoking all previous authorizations. If this is not the case, check the box where indicated. You must also attach a copy of any withholding tax authorizations you wish to remain in effect.

Arizona Withholding Tax Information Authorization 821 Step 12: Section 5 should be signed by you and another taxpayer if applicable. Both parties should also print their name, as well as entering the date and their title.

Living Will

INSTRUCTIONS: MONTANA DECLARATION OF LIVING WILL APPOINTMENT

To appoint someone with living will power concerning life-sustaining treatment in Montana or to create a living will to direct a doctor or nurse to withhold this treatment if it will only prolong life with no hope of recovery, use the documents discussed in this article. These documents can be obtained from the website maintained by the Montana Department of Public Health & Human Services.

Montana Declaration Of Living Will Appointment Step 1: The first page contains the form used to appoint someone to make decisions concerning life-sustaining treatment on your behalf in the event that you are unable to. Enter the name of the person being appointed on the first blank line.

Montana Declaration Of Living Will Appointment Step 2: Enter the name of an alternate appointee on the second blank line.

Montana Declaration Of Living Will Appointment Step 3: Enter the date of the day on the third blank line.

Montana Declaration Of Living Will Appointment Step 4: Enter the month on the fourth blank line.

Montana Declaration Of Living Will Appointment Step 5: Enter the last two digits of the year on the fifth blank line.

Montana Declaration Of Living Will Appointment Step 6: Enter your signature on the sixth blank line.

Montana Declaration Of Living Will Appointment Step 7: Print your name on the seventh blank line.

Montana Declaration Of Living Will Appointment Step 8: Enter your address on the next two blank lines.

Montana Declaration Of Living Will Appointment Step 9: Two witnesses should enter their names and addresses at the bottom of the page.

Montana Declaration Of Living Will Appointment Step 10: The second page contains a living will expressing your desire to have life-sustaining treatment withheld in the event that there is no hope of recovery and you are unable to express your wishes. On the first blank line, enter the date of the day.

Montana Declaration Of Living Will Appointment Step 11: Enter the month on the second blank line.

Montana Declaration Of Living Will Appointment Step 12: Enter the last two digits of the year on the third blank line.

Montana Declaration Of Living Will Appointment Step 13: Enter your signature and printed name on the next two blank lines.

Montana Declaration Of Living Will Appointment Step 14: Have two witnesses enter their names and addresses where indicated.

Order of Informal Probate and Appointment of Personal Representative

INSTRUCTIONS: MONTANA ORDER OF INFORMAL PROBATE AND APPOINTMENT OF PERSONAL REPRESENTATIVE

This article discusses the form issued by a Montana judicial district court to informally appoint a personal representative in a probate matter. This document can be obtained from the website maintained by the Montana courts system.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 1: Enter the name and address of the person being issued this form at the top lefthand corner.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 2: Enter the phone number and name of the applicant for personal representative.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 3: On the first blank line, enter the number of the judicial district court.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 4: On the second blank line, enter the name of the county.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 5: On the next blank line, enter the name of the decedent in question.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 6: On the next blank line, enter the probate number.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 7: On the next blank line, enter the name of the applicant.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 8: On the next blank line, enter the name of the decedent.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 9: On the next blank line, enter the date of death.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 10: On the next blank line, enter the last two digits of the year of the date of death.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 11: On the next blank line, enter the name of the applicant.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 12: On the first and second blank lines on the second page, enter the name of the person appointed as personal representative.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 13: On the next blank line, enter the date.

Montana Order Of Informal Probate And Appointment Of Personal Representative Step 14: On the last blank line, the court of clerk will enter their signature.

Form 821-PSC Withholding Tax Payroll Service Company Authorization

INSTRUCTIONS: ARIZONA WITHHOLDING TAX PAYROLL SERVICE COMPANY AUTHORIZATION (Form 821-PSC)

To authorize a payroll service company to receive and inspect confidential documentation regarding Arizona withholding tax, you must file a form 821-PSC. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 1: Section 1 requires information about the taxpayer. On the first line, enter your name and daytime telephone number.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 2: On the second line, enter your street address or PO box number.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 3: On the third line, enter your city, state and zip code.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 4: In the box on the right, enter your Employer Identification Number (EIN).

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 5: Section 2 requires information about the payroll service company being authorized. On the first line, enter their name and identification number.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 6: On the second line, enter their street address or P.O. box number and their telephone number.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 7: On the third line, enter their city, state, zip code and fax number.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 8: Section 3 states that you are authorizing the payroll service company in question to discuss confidential documentation with the Arizona Department of Revenue, as well as making deposits to that department and filing and signing tax returns. Enter the year from which going forward the payroll service company is authorized to take these steps.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 9: Section 4 states that this authorization automatically revokes all previous authorizations filed for this period. If this is not the case, check the box where indicated and attach copies of all authorizations you wish to remain in effect.

Arizona Withholding Tax Payroll Service Company Authorization 821-PSC Step 10: Section 5 only needs to be read, not completed. In section 6, at least one taxpayer and up to two must print their name on the first line, provide their signature on the second line, and enter the date on the third line.