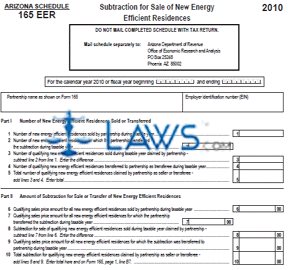

Form 165 EER EER Subtraction for Sale of New Energy Efficient Residences

INSTRUCTIONS: ARIZONA SUBTRACTION FOR SALE OF NEW ENERGY EFFICIENT RESIDENCES (Form 165 EER)

Partnerships deriving income from the sale of new energy efficient residences in Arizona document the subtraction on their tax returns by filing a form 165 EER. This document can be obtained from the website maintained by the Arizona Department of Revenue.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 1: If not filing for the calendar year printed on the form, enter the beginning and ending dates of your partnership's fiscal year.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 2: Enter your partnership name as it appears on form 165.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 3: Enter your employer identification number.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 4: On line 1, enter the number of new energy efficient residences sold by your partnership during the taxable year.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 5: On line 2, enter the number of new energy efficient residences for which the partnership transferred the transaction for the taxable year.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 6: Subtract line 2 from line 1. Enter the resulting difference on line 3.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 7: On line 4, enter the number of qualifying new energy efficient residences transferred to the partnership as a transferee during the taxable year. Add lines 3 and 4. Enter the resulting sum on line 5.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 8: Enter the qualifying sales price amount for all new energy efficient residences sold by the partnership during the taxable year on line 6, and the same amount for all such residences for which the partnership transferred the subtraction during the taxable year on line 7.

Arizona Subtraction For Sale Of New Energy Efficient Residences 165 EER Step 9: Subtract line 7 from line 6. Enter the resulting difference on line 8. Enter the qualifying sales price amount for all new energy efficient residencies for which the subtraction was transferred to the partnership during the taxable year on line 9. Enter the sum of lines 8 and 9 on line 10.