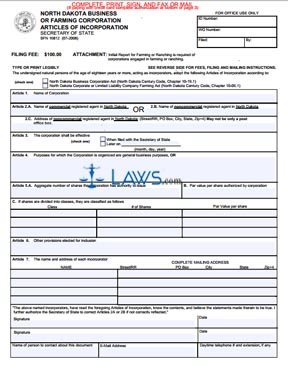

Form SFN 16812 North Dakota Business or Farming Corporation Articles of Incorporation

INSTRUCTIONS: NORTH DAKOTA BUSINESS OR FARMING CORPORATION ARTICLES OF INCORPORATION SGN 16812

These forms are required in forming a business corporation or a farming corporation in the state of North Dakota. You’re strongly encouraged to consult with an attorney before completing this form.

“North Dakota Business or Farming Corporation Articles of Incorporation SGN 16812 Step 1”

Check the appropriate box above the first Article. List the name of the corporation in Article I. Make sure the name include one of the following designations: company, corporation, incorporated, limited, or an appropriate abbreviation.

“North Dakota Business or Farming Corporation Articles of Incorporation SGN 16812 Step 2”

State the name of the commercial registered agent or the noncommercial registered agent in Article 2A. If you’ve received approval from a noncommercial registered agent, provide their street address in Article 2C.

“North Dakota Business or Farming Corporation Articles of Incorporation SGN 16812 Step 3”

Check the appropriate box in Article 3. If you want to delay the effective date, check box 2 and provide an effective date.

“North Dakota Business or Farming Corporation Articles of Incorporation SGN 16812 Step 4”

State the general purpose of the corporation in Article 4. If you’re forming a professional corporation, provide specific statements.

“North Dakota Business or Farming Corporation Articles of Incorporation SGN 16812 Step 5”

State the total number of authorized shares under the corporation in Article 5. The corporation or farm corporation needs at least one share. State the par value of each share in Article 5B. If there is no par value, leave the line blank.

If the shares are separated into different classes, explain the class, number of shares in each class, and the par value of each share in Article 5C.

“North Dakota Business or Farming Corporation Articles of Incorporation SGN 16812 Step 6”

If the corporation wants to include any additional Articles, attach separate sheets as needed and specify the additions in Article 6.

“North Dakota Business or Farming Corporation Articles of Incorporation SGN 16812 Step 7”

List the names and mailing address for each incorporator in Article 7. All of the incorporators listed within this Article need to sign the bottom of this form. Provide the name and telephone number of a contact person as well.

“North Dakota Business or Farming Corporation Articles of Incorporation SGN 16812 Step 9”

The filing fee for this form is $100.00. You can mail or fax the form.