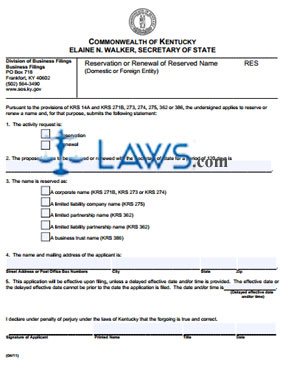

Form 79 Application For Reservation Of Name

INSTRUCTIONS: APPLICATION FOR RESERVATION OF NAME 79

You can use this form to request a name reservation for a business in the state of Montana. You cannot file this form if you’ve already filed or are currently filing any of the following forms:

· Registration of Assumed Business Name

· Registration of Limited Liability Partnership

· Certificate of Limited Partnership

· Articles of Incorporation

· Articles of Organization

“Application for Reservation of Name 79 Step 1”

Check the appropriate box at the top of this form and write the reserved name on the first line. Make sure the name contains a designation required by law, and emphasize the spaces between the words.

“Application for Reservation of Name 79 Step 2”

Provide a date on the second line indicating when the applicant will commence business. Please note that a name can only be reserved for 120 days before the commencement of business.

“Application for Reservation of Name 79 Step 3”

List the name and business mailing address of the applicant in section 3.

“Application for Reservation of Name 79 Step 4”

Provide a description of the business in section 4. One of two sentences is enough. The applicant needs to sign and date the bottom of this form. Make sure the applicant provides their printed name, telephone number, and email as well.

“Application for Reservation of Name 79 Step 5”

The filing fee for this form is $10.00. Expedited service within 24 hours is $30.00, and expedited service within an hour is $110.00. Make the check payable to Secretary of State.

“Application for Reservation of Name 79 Step 6”

Use the following address when you’re mailing the form:

Linda McCulloch

Secretary of State

P.O. Box 202801

Helena, MT 59620-2801

“Application for Reservation of Name 79 Step 7”

Normal service will take about 10 days. The state will check to see if the form meets statutory requirements. If the state finds a deficiency, the form is returned to the applicant. If the form is complete, the state will send a certificate to the applicant. Make sure to tell the state you want a “filed stamped” copy of the document when they return the certificate.

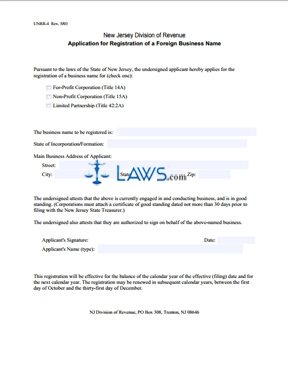

Form Domestic Corporation Filing Packet

INSTRUCTIONS: DOMESTIC CORPORATION FILING PACKET

“Domestic Corporation Filing Packet Step 1”

Provide the name of the corporation in Article 1. Make sure the name contains a designation such as the following: Incorporated, Inc., Limited, Ltd., Company, Co., Corp., or similar words.

“Domestic Corporation Filing Packet Step 2”

Check the appropriate box in Article 2. If you check the first box, provide the name of the commercial agent. If you check either box in row two, provide the name, street address, and mailing address if different from the street address.

“Domestic Corporation Filing Packet Step 3”

Provide the number of authorized shares in Article 3. Indicate the par value in the space provided. Also, list the number of authorized shares without par value in the appropriate box.

“Domestic Corporation Filing Packet Step 4”

List the names and addresses of the governing board in Article 4. If additional space is needed, list the name and address on a 8 ½ by 11 sheet.

“Domestic Corporation Filing Packet Step 5”

State the purpose of the corporation in Article 5. See the instructions within the form more information.

“Domestic Corporation Filing Packet Step 6”

Provide the names and addresses of the incorporators in Article 6. Attach a separate form if more space is required. Make sure all of the signatures appear beside the printed name.

“Domestic Corporation Filing Packet Step 7”

The registered agent needs to sign and date the bottom of this form. They also need to complete the Registered Agent Acceptance sheet in this packet.

“Domestic Corporation Filing Packet Step 8”

You need to regard the payment schedule in order to calculate your filing fees. The initial filing fee is contingent on the number of authorized shares.

If you want expedited service, you’re filing fee will increase between $125.00 and $1,000 depending on the type of service requested. A certified copy of this form will cost $30.00. There is an additional $2.00 for every page printed along with the copy. A ceremonial, colored charter is also available for $100.00 more.

“Domestic Corporation Filing Packet Step 9”

If you’re filing this form online, make sure you fill out and sign the form for your credit card information.