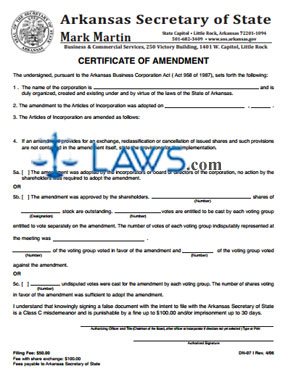

Form DN-07 Certificate of Amendment (new code – shares exchanged) (Corporation)

INSTRUCTIONS: CERTIFICATE OF AMENDMENT (new code-shares exchanged) (Corporation) DN-07

The applicant only needs to file one original certificate to the Business and Commercial Services under the Secretary of State. A copy does not need filed with the County Clerk. This form can be used to change the corporation’s name, officers, the registered agent, and other information.

“Certificate of Amendment (new code-shares exchanged) (Corporation) DN-07 Step 1”

Provide the name of the corporation on the first line of this document. Provide the date when the amendments to the Articles of Incorporation were adopted on line 2.

“Certificate of Amendment (new code-shares exchanged) (Corporation) DN-07 Step 2”

Provide the amended parts of the Articles of Incorporation in part 3. If the amendment states an exchange, reclassification or cancellation of issued shares but the changes are not stated in the amendment, provide the changes in part 4 of this document.

“Certificate of Amendment (new code-shares exchanged) (Corporation) DN-07 Step 3”

If the amendment was adopted by the incorporators or board of directors and nothing was required from the shareholders, check box 5a. If action was required from the shareholders for the amendment, check box 5b and state the number of shares that are outstanding. Provide the number of votes on the third line and the total number of votes from each group on the fourth line. Provide the number of undisputed votes and disputed votes on the 5th and 6th lines.

“Certificate of Amendment (new code-shares exchanged) (Corporation) DN-07 Step 4”

Check box 5c if there undisputed votes and the amendment were adopted. Provide the total number of undisputed votes.

“Certificate of Amendment (new code-shares exchanged) (Corporation) DN-07 Step 5”

The authorizing officer and their title need printed on the first line at the bottom of this document. The Chairman of the Board, and Officer, or an Incorporator needs to sign the bottom of the form.

“Certificate of Amendment (new code-shares exchanged) (Corporation) DN-07 Step 6”

If this form is mailed, the fee is $100.00 if shares are exchanged. If the form is submitted electronically, the fee is $90.00. If you’re mailing the form, provide a check made payable to the Arkansas Secretary of State. Mail the forms to the following address:

Arkansas Secretary of State

Business and Commercial Services

State Capital

Little Rock, AR

72201-1094

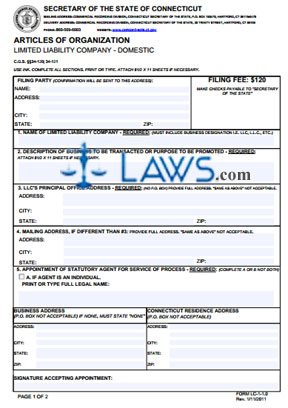

Form LC-1-1.0 Articles of Organization

INSTRUCTIONS: ARTICLES OF ORGANIZATION LC-1-1.0

This form is used to form a domestic limited liability company in the state of Connecticut. Review these instructions and the instructions within the form closely.

“Articles of Organization LC-1-1.0 Step 1”

In part 1, include the name of the LLC. The name must have one of the following designations: Limited Liability Company, LLC, L.L.C., Limited Liability Co., Ltd. Liability Company, or Ltd. Liability Co.

“Articles of Organization LC-1-1.0 Step 2”

Provide the nature of the business in part 2. The nature of business must qualify as legal under the Connecticut Limited Liability Company Act.

“Articles of Organization LC-1-1.0 Step 3”

Provide the principal office location of the LLC, including street number, street, city, state, and zip. If the mailing address is different, provide the address in part 4

“Articles of Organization LC-1-1.0 Step 4”

In part 5, provide a designated statutory agent for the service of process. Check the appropriate box. The LLC can appoint an individual if they have a personal or business street address in Connecticut.

The LLC can appoint a domestic corporation, LLC, LLP or statutory trust as a statutory agent as well. The LLC can also appoint a foreign corporation, LLC, LLP or statutory trust with a certificate of authority to do business in Connecticut. The foreign entity must have a Connecticut address as well. The individual or agent for the entity needs to provide their signature as well.

“Articles of Organization LC-1-1.0 Step 5”

Part 6 is mandatory. Provide at least one name of a manager or member of the LLC. If additional space is required, provide an attachment on an 8 ½ x 11 sheet.

“Articles of Organization LC-1-1.0 Step 6”

If the management of the LLC is held by the manager or group of managers, select the box in part 7.

“Articles of Organization LC-1-1.0 Step 7”

Each organizer must provide a signature in part 8. A date indicating when the signatures occurred is also required. Provide an additional sheet if necessary.

“Articles of Organization LC-1-1.0 Step 8”

The filing fee for this form is $120, and the check needs make payable to the Secretary of the State. You can find the mailing address and delivery address at the top of this form. If you have a question, you need to contact your attorney.