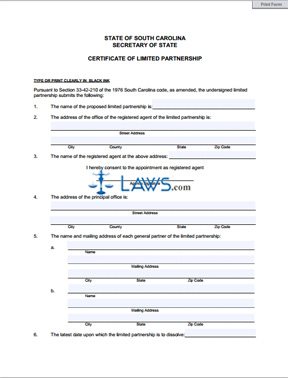

Form HI Articles of Incorporation

INSTRUCTIONS: HI ARTICLES OF INCORPORATION

Use this form if you’re attempting to form a corporation in the state of Hawaii. You can find requirements for the Articles of Incorporation in §414-32 of the Revised Statutes.

“HI Articles of Incorporation Step 1”

Write the name for the corporation exactly as it appears in section I. If you’ve filed a name reservation form in the state of Hawaii, attach the certificate from the Department of Commerce to this form. The name of the corporation needs to contain the word Corporation, Incorporation, Limited, Corp., Inc., or Ltd.

“HI Articles of Incorporation Step 2”

Indicate the mailing address for the corporation’s initial principal office in section II including city, state, and zip code.

“HI Articles of Incorporation Step 3”

In section III(a), provide the name of the corporation’s registered agent. A qualified registered agent is an individual, domestic business entity, or a foreign business entity allowed to conduct business in Hawaii. If the registered agent is an entity, provide its state or country.

Provide the street address for the registered agent in section III(b). Any future service of process and other documents will be forwarded to this address.

“HI Articles of Incorporation Step 4”

Highlight the number of common shares the corporation can legally issue in section IV.

“HI Articles of Incorporation Step 5”

Provide the name and full address of each incorporator in section V. If more room is needed, attach a separate sheet.

“HI Articles of Incorporation Step 6”

At least one incorporator needs to date and sign the bottom of this form. Additional incorporators can choose to sign the form as well.

“HI Articles of Incorporation Step 7”

The filing fee for this form is $25.00, and the fee is non-refundable. If you request certified copies, each copy will cost $10.00. Make all checks payable to Department of Commerce and Consumer Affairs.

“HI Articles of Incorporation Step 8”

Make a copy of the original and the documents and filing fee to the following address:

State of Hawaii

Department of Commerce and Consumer Affairs

Business Registration Division

P.O. Box 40

Honolulu, Hawaii 96810

Form NJ Complete Business Registration Packet

INSTRUCTIONS: NJ COMPLETE BUSINESS REGISTRATION PACKET

You should never complete any form in this packet without consulting with an attorney. This packet provides all required form for registering any type of business in the State of New Jersey. Businesses need to file the Division of Revenue Business Registration Form (in most cases), and the Public Records Filing for New Business Entity form as well.

“NJ Complete Business Registration Packet Step 1”

A sole proprietorship or partnership needs to file pages 17-19 of this packet (NJ-REG). IF a corporation, limited liability company, limited partnership, or limited liability partnership has already filed a new business certificate with the Commercial Recording/Corporate Filing Unit, the business only needs to complete pages 17-19.

“NJ Complete Business Registration Packet Step 2”

Only complete pages 23 and 24 of this packet if the business has not filed a Commercial Recording. If a new business entity is filing the Public Records Filing for New Business Entity on pages 23 and 24, this form needs completed before filing NJ-REG. Not that NJ-REG needs submitted within 60 days of filing the Public Records Filing.

“NJ Complete Business Registration Packet Step 3”

If the business collects sales tax, the NJ-REG needs submitted at least 15 days before the date of first sale, the use of tax, or the use of NJ exemption certificates.

“NJ Complete Business Registration Packet Step 4”

After forming a new business entity, you need to apply for a federal employer identification number (FEIN). You can contact the IRS at 1-800-829-1040 for more information on obtain the FEIN. If you have other questions about this packet, you can contact the Client Registration Bureau at the following number (609) 292-9292.

“NJ Complete Business Registration Packet Step 5”

Look under pages 25 and 26 if you need to file a Registration of Alternate Name Form (C-150G). You can find instructions and forms for new hiring reporting on pages 27-36. Request for Change of Registration Information is located on page 37, and Business Entity Amendment Filing is located on page 39. Additional forms are located in this form as well.

“NJ Complete Business Registration Packet Step 6”

You can mail the forms to the following address:

Client Registration

PO Box 252

Trenton, NJ 08646-0252

For overnight delivery, use this address:

Client Registration

33 West State St 3rd FL

Trenton, NJ 08608

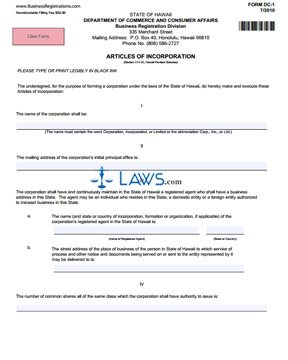

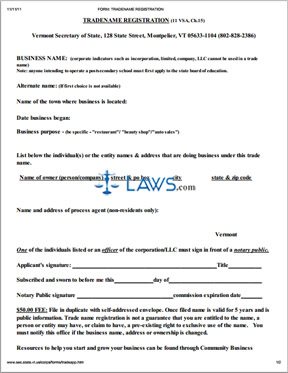

Form VT DBA Tradename Registration

INSTRUCTIONS: VERMONT DBA TRADENAME REGISTRATION

If you wish to register a name for your company in Vermont, this is done through the offices of the secretary of state. This form serves as form of public notification regarding your business and is also intended to help afford your business some protection from others making use of the same name. Their website has the application necessary to complete this registration. This article discusses the unnumbered questions in the order in which they appear. This form can be used by a sole proprietorship, association of multiple people or any other entity which wishes to operate under a newly registered name. Your application will not be approved if another Vermont business already has claimed the name.

Vermont DBA Tradename Registration Step 1: Enter the name you wish to be granted. Note that you cannot include indications of your corporate status in this name, such as "LLC" or "company."

Vermont DBA Tradename Registration Step 2: Enter an alternate name in case your first choice is not available.

Vermont DBA Tradename Registration Step 3: Enter the name of the city in which your business is located.

Vermont DBA Tradename Registration Step 4: Enter the date on which your business began operating.

Vermont DBA Tradename Registration Step 5: Enter the purpose of your business.

Vermont DBA Tradename Registration Step 6: Give the names and addresses of all individuals or companies who own the business.

Vermont DBA Tradename Registration Step 7: If you are a non-resident, you must include the name and address of your process agent.

Vermont DBA Tradename Registration Step 8: One of the individuals listed above or an officer must sign and date the form in the presence of a notary public.

Vermont DBA Tradename Registration Step 9: On the second page, include a telephone number and email address where the business can be contacted.

Vermont DBA Tradename Registration Step 10: File this form in duplicate with the Vermont Secretary of State. Include a self-addressed envelope.

Vermont DBA Tradename Registration Step 11: A $50 filing fee must be paid in order for your registration to be processed.

Vermont DBA Tradename Registration Step 12: Once this form has been approved, it will remain in effect for five years. If your name, address or ownership change during this period, you must inform the Secretary of State.

Form 701 LLP Application

INSTRUCTIONS: TEXAS REGISTRATION OF A LIMITED LIABILITY PARTNERSHIP (Form 701)

If you wish to form a limited liability partnership (LLP) in Texas, you will need to register your business. This article discusses form 701 which is filed in such cases. The form is available on the website of the Texas Secretary of State, which will be processing the application.

Texas Registration Of A Limited Liability Partnership 701 Step 1: Question one asks you to give the name of your LLP.

Texas Registration Of A Limited Liability Partnership 701 Step 2: Question two asks you to give the federal employment identification number of your business. If you have not yet been assigned one, indicate this with a check mark.

Texas Registration Of A Limited Liability Partnership 701 Step 3: Question three asks you to state how many partners are in this business.

Texas Registration Of A Limited Liability Partnership 701 Step 4: Question four asks you to provide the complete address of the principal office.

Texas Registration Of A Limited Liability Partnership 701 Step 5: Question five asks you to provide a brief description of the business the LLP is engaged in.

Texas Registration Of A Limited Liability Partnership 701 Step 6: The section headed "effectiveness of filing" asks you to indicate when you would like your LLP status to formally take effect.

Texas Registration Of A Limited Liability Partnership 701 Step 7: If the company filing is a general partnership, the majority-of-interest of partners must sign, or at least one or more partners authorized by the majority-of-interest of partners should sign. If the company filing is a limited partnership, any general partner may sign.

Texas Registration Of A Limited Liability Partnership 701 Step 8: The filing fee for this application is $200 for every general partner named in the registration form. The fee can be paid via check or money order made out to the Secretary of State, or a credit or debit card.

Texas Registration Of A Limited Liability Partnership 701 Step 9: The registration form can be mailed or delivered in person to the address listed in the instructions. You may also submit the form via fax.

Texas Registration Of A Limited Liability Partnership 701 Step 10: Submit two copies of the application. A file-stamped copy of one will be returned to you once your registration has been processed.