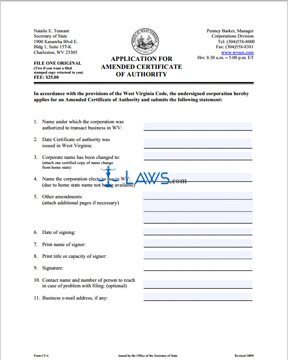

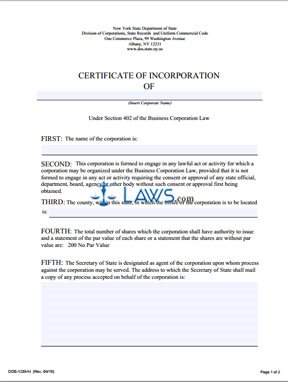

Form DOS-1239-f-l Certificate Incorporation

INSTRUCTIONS: CERTIFICATE OF INCORPORATION DOS-1239-F-L

Use this form to begin the process of forming a corporation in the state of New York. The applicants are not required to hire an attorney to help with the form, but the state strongly encourages legal help while completing this form and other forms as well.

“Certificate of Incorporation DOS-1239-f-l Step 1”

Provide the name of the corporation in the first section of this form. May sure the name contain the word “Incorporated,” the abbreviation “Inc.,” or any other appropriate terms under §301 of the Business Corporation Law. Access the following link for terms you cannot use within a corporation’s name: https://www.dos.ny.gov/corps/restricted_words.html.

You can also use the following link if you have not already completed a name reservation form and you want to check the availability of the name: https://www.dos.ny.gov/corps/bus_entity_search.html.

“Certificate of Incorporation DOS-1239-f-l Step 2”

Do not alter the words in the second section of this form. This type of phrasing is required by state law and tells the state the corporation will not conduct any illegal activities.

“Certificate of Incorporation DOS-1239-f-l Step 3”

In the third section, enter the county where the principal office of the corporation is located within the state of New York.

“Certificate of Incorporation DOS-1239-f-l Step 4”

Provide the total number of authorized shares in the fourth section along with a statement of the estimated par value. Attach a separate sheet if more room is needed.

“Certificate of Incorporation DOS-1239-f-l Step 5”

Enter the address for the registered agent in the fifth section. Make sure to provide the street number, street name, city, state, and zip code.

“Certificate of Incorporation DOS-1239-f-l Step 6”

Each incorporator needs to provide their printed name, address, and signature within this Certificate. If there is more than one incorporator, attach a separate sheet. Additionally, the filer of this form needs to provide their name and mailing address at the bottom of this form as well.

“Certificate of Incorporation DOS-1239-f-l Step 7”

The filing fee for this form is $125.00 plus a minimum tax on shares of $10. A larger number of shares will increase the filing fees. Make the check payable to the Department of State. Mail the completed form, a duplicate, and the filing fee to the address provided at the top of this form.

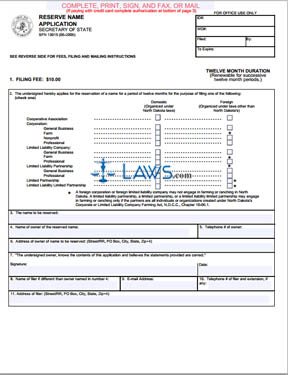

Form SFN 13015 Reserve Name Application

INSTRUCTIONS: RESERVE NAME APPLICATION SFN 13015

Use this form to reserve a name for a cooperative association, corporation, limited liability company, limited liability partnership, limited partnership, or limited liability limited partnership authorized to conduct business in North Dakota. Regard these instructions and the instructions in the form closely.

“Reserve Name Application SFN 13015 Step 1”

Check the appropriate box in section 2. It’s important to note that a foreign corporation or foreign limited liability company cannot farm or ranch in North Dakota.

“Reserve Name Application SFN 13015 Step 2”

In section 3, state the name of the name to be reserved. Make sure you provide the following designations depending on the type of company:

1. Cooperative Association: corporation, incorporated, or appropriate abbreviation.

2. For-Profit Corporation: company, corporation, incorporated, limited, or an appropriate abbreviation.

3. Nonprofit Corporation: corporation, incorporated, limited, or an appropriate abbreviation.

4. Professional Corporation: chartered, limited, professional corporation, professional association, or an appropriate abbreviation.

5. Limited Liability Company: limited liability company, L.L.C., or LLC.

6. Professional Limited Liability Company: professional limited liability company, limited liability company, P.L.C, P.L.L.C., PLLC, L.L.C, or LLC.

7. Limited Liability Partnership: limited liability partnership, L.L.P., or LLP.

8. Professional Limited Liability Partnership: professional limited liability partnership, P.L.L.P., PLLP, L.L.P., or LLP.

9. Limited Partnership: limited partnership, L.P., or LP.

10. Limited Liability Limited Partnership: limited liability limited partnership, L.L.L.P., or LLLP.

“Reserve Name Application SFN 13015 Step 3”

Enter the full name of the owner of the proposed company in section 4. List the telephone number of the owner in section 5, and the complete address for the owner in section 6.

“Reserve Name Application SFN 13015 Step 4”

The owner needs to sign and date section 7. If the filing party is not the owner, the need to provide their name, email address, telephone number, and address in section 8-11.

“Reserve Name Application SFN 13015 Step 5”

The filing fee for this form is $10.00. You can fax or mail this form along with the filing fee. If mailing the form, may the check payable to Secretary of State. If faxing the form, provide your credit card information and use the following fax number: 701-328-2992.

If you’re mailing the form and filing fee, use the following address:

Secretary of State

State of North Dakota

600 E Boulevard Ave Dept 108

Bismarck, ND 58505-0500