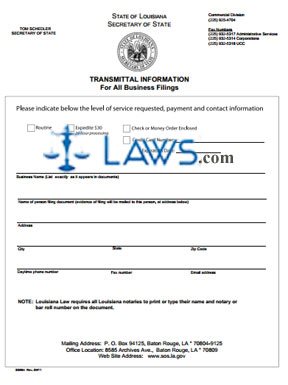

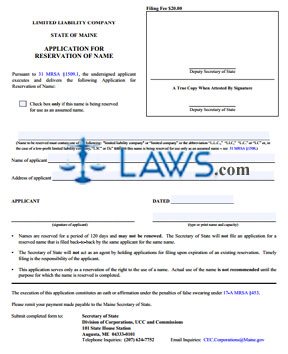

Form MLLC-1 Application for Reservation of Name

INSTRUCTIONS: APPLICATION FOR RESERVATION OF NAME MLLC-1

This form is used to reserve the name of a limited liability company in the state of Maine. If the name is approved by the Secretary of State, the name is reserved for a total of 120 days. The reservation cannot be renewed in the state of Maine.

“Application for Reservation of Name MLLC-1 Step 1”

Check the box at the top of the Application if reservation is only for an assumed name. Otherwise, do not check the box.

“Application for Reservation of Name MLLC-1 Step 2”

On the line below the box, provide the requested name for the limited liability company. An limited liability company needs to use one of the following terms in the name: limited liability company, limited company, L.L.C., LLC, or LC. If the company is a low-profit LLC, the term “L3C” or “l3c” can be used unless the name reservation is for an assumed name.

“Application for Reservation of Name MLLC-1 Step 3”

Provide the full name of the applicant and the applicant’s address on the next set of lines.

“Application for Reservation of Name MLLC-1 Step 4”

The applicant needs to date, sign, and provide a printed name at the bottom of the Application.

“Application for Reservation of Name MLLC-1 Step 5”

Before filing this form, make sure you complete the Cover Letter. Instructions are listed below:

1. List the name of limited liability company on the first set of lines.

2. On the next set of lines, state that you’re filing the Application for Reservation of Name. If you’re filing any other forms, include the other titles as well.

3. Check the appropriate box in the next section, and list the total amount of filing fees.

4. Provide a contact person, telephone number, and email address.

5. State where an attested copy should be delivered on the last set of lines.

“Application for Reservation of Name MLLC-1 Step 6”

The minimum filing fee for this form is $20. Expedited service will cost more. Make the check or money order payable to Maine Secretary of State. Send the form and filing fee to the following address:

Secretary of State

Division of Corporations, UCC and Commissions

101 State House Station

Augusta, ME 04333-0101

Form Articles of Incorporation (Profit Corporation)

INSTRUCTIONS: ARTICLES OF INCORPORATION (PROFIT CORPORATION)

Read all instructions here and within the form before filing this document with the Minnesota Secretary of State. It’s a good idea to consult an attorney when completing this form.

“Articles of Incorporation (Profit Corporation) Step 1”

Provide the exact name for the corporation in Article I. The name needs to contain one of the following terms: Incorporated, Corporation, Limited, or Company. A professional corporation needs to use one of the following terms in the name: Professional Corporation, Professional Association, Professional Service Corporation, Service Corporation, Chartered, Limited, P.C., P.S.C., P.A., or Ltd.

Check the availability of the corporation’s name at the following link: www.sos.state.mn.us.

“Articles of Incorporation (Profit Corporation) Step 2”

Enter the street address for the registered office in Article II. A registered agent is not required. However, if the corporation does have a registered agent, enter their name on the line provided.

“Articles of Incorporation (Profit Corporation) Step 3”

The corporation needs at least one share. Provide the number of authorized shares in Article III.

“Articles of Incorporation (Profit Corporation) Step 4”

The corporation only needs one incorporator, but the filing party needs to list information on all incorporators in Article IV. The incorporator needs to provide their signature next to their address. If additional space is needed, provide a separate sheet. Make sure to provide a contact name, phone number, and address below the incorporator information for correspondence on this form.

“Articles of Incorporation (Profit Corporation) Step 5”

The filing fee for this form is $135.00, and expedited service will cost more. For questions on filing fees, call (651) 296-2803 or toll free at 1-877-551-6767. Make the check payable to MN Secretary of State.

“Articles of Incorporation (Profit Corporation) Step 6”

Once you’ve completed the Articles and included the filing fee, you can send or drop off the forms to the following address:

Minnesota Secretary of State – Business Services

Retirement Systems of Minnesota Building

60 Empire Drive, Suite 100

St Paul, MN 55103

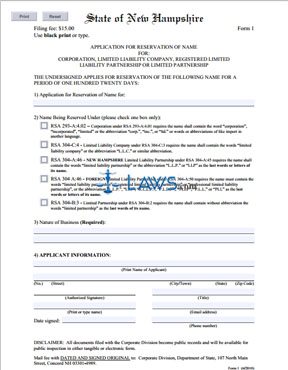

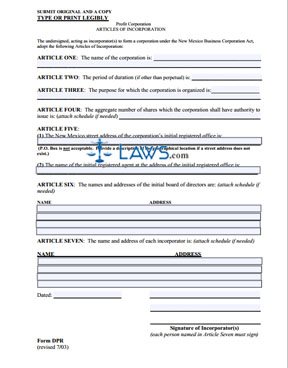

Form DPR Incorporation Application Packet

INSTRUCTIONS: DPR INCORPORATION APPLICATION PACKET

Use this packet to begin the process of establishing a for-profit corporation in the state of New Mexico. Even though the packet provides instructions, you should still consult with an attorney while completing this form.

“DPR Incorporation Application Packet Step 1”

State the corporate name in Article I. Make sure the name contains one of the following designations: corporation, company, incorporated, limited, or an appropriate abbreviation. If the business professional corporation, use one of the following words: limited, chartered, professional association, or professional corporation.

“DPR Incorporation Application Packet Step 2”

If the corporation is expected to dissolve in the future, include a specific date in Article II. If no limit of time is expected, leave the space blank.

“DPR Incorporation Application Packet Step 3”

In Article III, state the corporation’s main type of conducted business. One or two sentences is enough.

“DPR Incorporation Application Packet Step 4”

In Article IV, provide the number of authorized shares under the corporation. If the shares fall in different classes, attach a separate statement indicating each class, the designation of each class, preferences, limitations, and general rights for each class. For more information on the shares, refer to the notes below the instructions in this packet.

“DPR Incorporation Application Packet Step 5”

Enter the street address for the corporation’s registered office in the first section of Article V. Provide the name of the registered agent in section 2. Remember, the registered agent needs to complete the Statement of Acceptance, regardless if the agent is an individual or corporation.

“DPR Incorporation Application Packet Step 6”

Enter the name and address for each director in Article VI. If more space is needed, attach a separate sheet.

“DPR Incorporation Application Packet Step 7”

List the name and address of each incorporator in Article VII. If additional space is needed, attach a separate sheet. All of the incorporators need to sign the bottom of this form.

“DPR Incorporation Application Packet Step 8”

The minimum filing fee for this form is $100, and the maximum fee is $1,000. The filing fee depends on the number of authorized shares. Contact the state for more information. Make the check or money order payable to New Mexico Public Regulation Commission. Send the completed forms and duplicates to the following address:

Public Regulation Commission

Corporations Bureau

Chartered Documents Division

P.O. Box 1269

Santa Fe, New Mexico 87504-1269

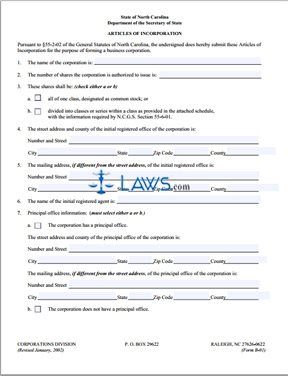

Form B-01 Articles of Incorporation

INSTRUCTIONS: ARTICLES OF INCORPORATION B-01

Complete and file this form with the Secretary of State to begin the process of forming a corporation in the state of North Carolina. You should consult with an attorney before completing this form.

“Articles of Incorporation B-01 Step 1”

Enter the name of the corporation in Article I. Make sure the name contains one of the following designations: corporation, company, limited, incorporated, corp., co., ltd, or inc.

“Articles of Incorporation B-01 Step 2”

In Article II, list the number of authorized shares under the corporation. Then, check option (a) or (b) in Article III. If you check option (b), make sure you include an attach that specifies designations, preferences, limitations, and general rights to the classes of stock.

“Articles of Incorporation B-01 Step 3”

In Article IV, list the complete street address for the registered office and the county where the office is located. If the corporation wants the mail delivered to a different address, list a mailing address in Article V.

“Articles of Incorporation B-01 Step 4”

Provide the name of the corporation’s registered agent in Article VI. A registered agent qualifies as an individual resident of the state or a different corporation authorized to conduct business in North Carolina.

“Articles of Incorporation B-01 Step 5”

In Article VII, check option (a) or (b). Check option (a) if the corporation has a principal office and list the street address for the principal office. Check option (b) if there is no principal office for the corporation

“Articles of Incorporation B-01 Step 6”

If the applicant wants to list other provisions, Article VIII asks for the applicant to attach a separate form.

“Articles of Incorporation B-01 Step 7”

Provide the name and address for each incorporator in Article IX. If additional space is needed, attach a separate sheet.

“Articles of Incorporation B-01 Step 8”

If the applicant wants the Articles to become effective on a later date, list a date in Article 10. Otherwise, the Articles become effective once approved by the Secretary of State.

“Articles of Incorporation B-01 Step 9”

An incorporator or representative needs to sign the bottom of this form.

“Articles of Incorporation B-01 Step 10”

The filing fee is $125. Make a check payable to Secretary of State. Send the completed forms to the following address:

Secretary of State

Corporations Division

P.O. Box 29622

Raleigh, NC 27626-0622